South Street Securities to target securities finance solutions

South Street Securities Holdings (SSSHI) has said the development of new solutions that can be deployed by its traders as well as its clients represents a “key aspect of growth”.

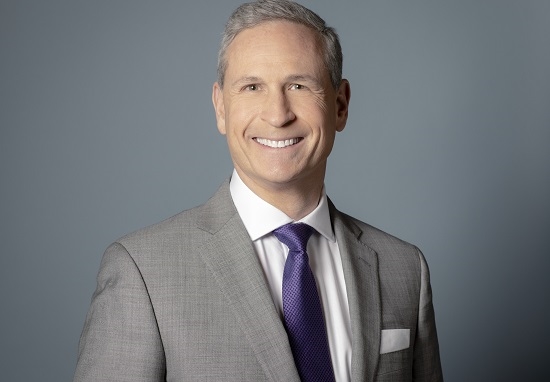

Speaking to Global Investor, Anthony Venditti, head of strategic initiatives and sales at South Street Securities, said: “South Street has multiple systems through its financial technology affiliate, Matrix Applications. This not only helps us facilitate our trading and financing business, but also other institutional firms and asset managers. Right now, we are teaching our fixed income systems not only what an equity is, but also important flows around securities lending.”

Venditti said South Street sees Delta One as a particular area of focus for the firm in 2022 and the years ahead.

“At South Street, we are a team of experienced professionals that focus not only on credit risk but also term/gap risk. So, Delta One trading fits into the DNA of South Street. We try to eliminate as much market risk as we can and hedge our interest rate risk. Our strategy is to create our own supply/demand in names that our clients are active in, helping them access liquidity,” he said.

Integrating equity finance into the South Street’s systems and flows is not only critical for the New York-based firm but also its clients and partners, Venditti believes.

“As we enhance our technology and build our business, this will help us be better providers and partners for our clients which is a key growth aspect for us. Although we may have some clients focused on fixed income, at some point they may look to expand just like us. And we’ll be there to support them,” he said.

Venditti joined South Street to kick-off the firm’s move into equity finance and help with marketing and capital raising in 2020. Since its establishment, the firm continues to onboard new counterparties and joined the Options Clearing Corporation in March 2022.

With a commitment to constant improvement, Venditti stated that South Street is looking into new initiatives to help facilitate their clients’ electronic capabilities.

“We have been spending a fair amount of time and money to make our US securities lending business more electronic and low touch. Headcount is a huge driver of costs and if we deploy strong technology with a few great traders that puts us at a huge advantage going forward,” he said.

Looking ahead, South Street is seeking to expand its client and asset base, and increase partnerships with technology firms specialised in risk, credit, onboarding and anti-money laundering, among other areas.

“We are currently looking for strategic partners in different technologies. When we invest in them it’s because we believe in their vision and management team. Plus, it helps us diversify into other assets, and expand our clients and/or balance sheet,” Venditti stated.

The capital will be used to expand research and development resources, and accelerate product development tailored to the needs of Kayenta's hedge fund clients, Venditti explained

"We are excited to partner with Kayenta. They are a great complement to our existing business, and we believe we can provide value to their platform on both the fixed income and repo space. We are confident in the Kayenta team and this should be a win-win for both sides," he said.

“Our investment in Digital Prime gives our firm and clients a clear view of all their positions, cash and collateral movements within a secure digital custodial environment. Investing in technologies that help us and our clients puts SSSHI in a unique position. I like to say we are a ‘technology company with a balance sheet’ instead of a ‘trading company with good technology’,” Venditti said.

SSSHI is a mid-sized firm with technology and operational expertise that stands out, he explained.

“We help other smaller to mid-sized firms, along with the larger ones, navigate new markets and help them with technology build-outs. So, we are a flexible and make our systems cost-effective and advantageous for others.”

Beyond the technology and trading platforms, South Street also has the ability to service clients’ fixed income portfolios and flows.

“We believe this is a major differentiator that sets us apart from other technology providers. We see the operational outsourcing space as a great growth opportunity for us. It fits in well with what we are doing in the securities lending space. There are a lot of new players in the robo/retail/digital brokerage space that need help. So, we believe we are positioned to outsource some of the funding business and operations that goes along with it.

“This helps keep costs and headcount down for new entrants that want to settle and clear in the US market. Instead of having to clear through other firms, sometimes it is better to open your own broker dealer to save expenses and maintain your client’s business flow,” Venditti concluded.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you