Part Three: Generali Asset & Wealth chief Trabbatoni considers ESG challenges

This is the third installment in a three part series based on an interview with Generali Asset & Wealth chief executive Carlo Trabbatoni. To access the first part of the series, click here. The second part of the interview, is available here.

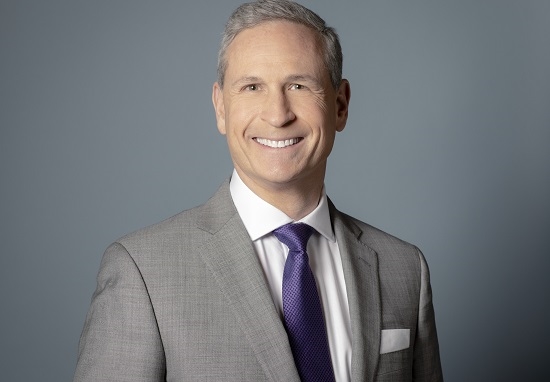

Carlo Trabbatoni, the chief executive of Generali Asset & Wealth, has adopted a pragmatic position on the fast-growing environmental, social and governance investment market.

He said: “There is still room for the energy sector and the themes that are linked to the scarcity of commodities to come back when the war scenario will have settled. I think this could be more of a buying opportunity than a selling obligation but, if anyone is invested, I would stay invested. If anyone is looking to invest, it is a good moment but expect significant volatility.”

The chief executive said Generali Investments has pledged to exclude investment in thermal such as coal etc in OECD countries by 2030 and by 2040 for the rest of the world, and to be carbon neutral by 2050.

He continued: “If things get prolonged, I suppose it may come to coal re-investment or net-zero, firms will have to look at that in the context of what could be an energy crisis. For the moment, nothing has changed however. The group has committed from €8.5bn-€9.5bn of sustainable investments up until 2025 so we are very much looking at ESG as an integral part of our investment approach.”

Sycomore, which boasts 20 years of market-leadership in ESG and €9bn of assets under management in European Commission-regulated Article 8 and Article 9 funds, is the Italian firm’s focal point for ESG activity.

Trabattoni said it is important for the group to develop a sophisticated ESG strategy “because this is what is being requested by our client base”.

He added: “When it comes to the offer for non-captive clients, all of our products are going to be Article 8 or Article 9 so ESG is at the core of our investment decision-making.”

But the Generali Asset & Wealth chief feels that more work needs to be done by the investment industry and its regulators.

“The industry has to find a proper position here, it has to find a balance between very strong beginnings for ESG and the reality.”

Trabattoni said: “If you look at the result of the structural under investment in energy, which is illustrated in the fact that energy prices are going through the roof, are we prepared to move towards a full ESG approach or is it the transition that we have to work upon? Those transitions cannot protect those firms that will not match the principle of ESG but we can’t abandon them. We have to help them transition to a new reality.”

The European Union’s taxonomy and Disclosure Regulation have drawn criticism in recent months for being of only limited use in determining what is and isn’t a sustainable investment.

Trabattoni continued: “It is important that the industry sets some rules for itself that are not so draconian. This dreadful episode in the Ukraine is showing us that if an energy shock comes, we may all be forced to move back to something that we have to reinclude in our portfolios. This is something that we have to work on from an industry perspective.”

The Generali Asset & Wealth chief said the inclusion in the European taxonomy of nuclear energy is an example of ESG standards responding to real-world issues.

“There has been a strong push towards something that I think is incredibly important but, now, from the extreme, we have to go back and position ourselves a bit that is a reflection of the world we live in.”

In the same vein, Russia’s attack on Ukraine raises some interesting questions about defence stocks, and whether it is appropriate to invest in these names.

Trabattoni said: “Up until a few months ago in Europe, the word ‘defence’ was not on the table. But now we are asking if defence is so vital to maintain peace, is the analogy that defence causes social harm not strange?

He added: “This is of course a current debate but I’d suggest that defence is going to be an important part of rebuilding of our European assets so would you exclude those from your portfolios right away?”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you