MUFG’s Securities Lending Solutions adopts ‘data driven’ focus

MUFG’s Securities Lending Solutions to become ‘data driven’ business

Mitsubishi UFJ Financial Group’s (MUFG) Securities Lending Solutions has said it plans to become a “data driven” business to cater to the evolving needs of clients.

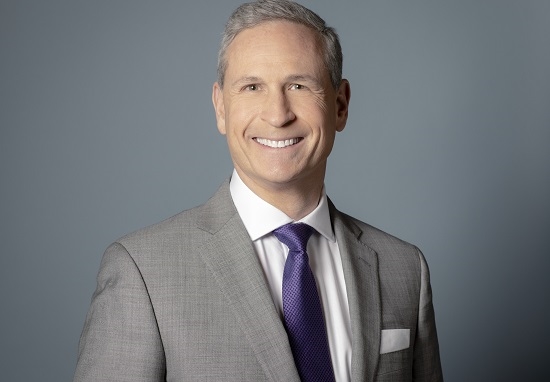

Speaking to Global Investor, Anthony Toscano, head of North American Global Securities Lending Solutions at MUFG, said in the past the business was primarily regionally focused with a mostly Japanese client base and that structure had been maintained for several years in terms of adapting to changes in regulations and client demands.

“However, in 2019 we made a significant investment to begin to grow this business to expand into investor bases beyond Japan and to get more active in the market to create revenue opportunities for these clients in the securities financing world. Our growing global client base hires us to canvas their approved counterparts for all opportunities which fit their collateral and risk profiles.

“Hence, we want our business to be very data driven and we are now importing significant amounts of data from various sources to make smart decisions about how we price portfolios for clients who want to join our lending program, how we price individual securities when we put them out on loan and how we price risk associated with any sorts of collateral we might take back. And this has been a big difference for us,” he said.

Toscano said the bank’s trust arm, Mitsubishi UFJ Trust & Banking Corporation’s Securities Lending, is a price-maker rather than a price-taker.

“I think, generally the view is that securities lenders lend securities at a price the counterpart wants to borrow them at. We prefer to lend securities at a price that we believe is fair, and that we can come to an agreement with the counterpart. It’s a subtle difference but I think on average, it manifests itself within the performance of the client.”

MUFG uses EquiLend’s Spire securities finance system as its core global platform, as well as S&P Global’s securities lending market data which allows the firm to export securities lending activity directly to the clients, Toscano explained.

“Ultimately, we are an extension of our clients when we act as their securities lending agent. We're building solutions for clients who cannot find them with their custodians right now, whether that would be reporting, performance and/or transparency. We are customising solutions for large institutional investors that make the biggest impact to them, rather than catering to the masses,” he added.

When it comes to advancements in technology such as the implementation of distributed ledger technology (DLT) in securities finance, Toscano sees it as an important evolution.

He said: “I see tremendous benefits to DLT and we will stay interested as it continues to evolve. However, I don't see us being on the forefront of cryptocurrency lending because that is not what our clients currently ask us to lend.”

Investors all have different priorities when it comes to the future, says Toscano who joined MUFG in 2009 from Deutsche Bank.

“Some investors try to manage money based on a very old set of guidelines that don't evolve very quickly. Others are on the cutting edge of long-short strategies, exchange-traded funds and high yield programs. So, we need to be able to respond to any one of those clients. I think there'll be many investors, who will be forced into adopting DLT and not because they want to adopt it. It will be the custodians giving direction and saying this is what needs to be done. But, at MUFG, we will take our cues from our clients directly,” Toscano stated.

Transparency remains the industry’s core issue today as it has been for the last 20 years, according to Toscano.

“As we are an extension of our clients, we want to give them as much information about the securities lending activity that's occurring as possible. We believe that’s their information so we should be able to provide it for them.”

However, the challenge is that different jurisdictions require different levels of transparency, he believes, and regulations such as Europe’s securities financing transactions regulation (SFTR) and the US Securities and Exchange Commission’s (SEC) proposed rule 10c-1 do aim to increase transparency.

“With the rule 10c-1, after the SEC has given firms comment period, it's my expectation that they'll gravitate to something similar with SFTR. And that makes sense as we would have a global view on transparency, but firms need to respond,” he said.

However, while the overall belief is that transparency is better for the industry, the proposed rule 10c-1 does create a higher barrier of entry for new participants in the marketplace, he argues.

“Overall, you need to have a global approach to how you do the business and having a global approach helps disperse the expense and capture a diverse understanding. The approach should be that all data in the program should be consumable by either clients or regulators at any time. You also must look to find the most efficiencies possible in order to capture demand, price appropriately and minimise manual intervention,” Toscano said.

Environmental, social, and governance (ESG) is another pressing issue because all investors are talking about it, he continued.

“The definition of ESG varies, and we define ESG on a client-by-client basis,” he said.

MUFG allows clients to create their own guidelines when it comes to implementing ESG in its lending program, Toscano said.

“We start off with documentation where the client defines virtually every aspect of how they want us to run the business. That then gets translated into front end compliance into the system, so the traders don't need to spend time interpreting guidelines prior to transacting or understanding if the client does or doesn't want to take a certain type of collateral or if a client wants to vote all proxies. It’s all done in the system in advance.”

However, as markets evolve, so do clients’ interpretations of or views on risk, so MUFG keeps that dialogue up with customers to react to changes they want in the program and follow that process accordingly, Toscano explained. Moving forward, we will be making some strategic hires to the business, Toscano said.

“We want to make sure we have a diverse team. It is also important for us to look for curious people who are team players as we are driven to succeed as a team and our team is global. So, we are looking for people who understand that they're part of a bigger organisation and their success is based on the success of the business and the satisfaction of our clients,” he explained.

Working at MUFG requires staff to have an intimate knowledge of the clients, what they own and what their expectations are as well as counterparts in terms of what they need and what their binding constraints may be to execute on a transaction, Toscano explained.

“So, as well as investing heavily in our staff with around 25 new hires made in the past two years, we are also training our existing staff making sure we have a unified approach to servicing clients and counterparts.

There is also a fair amount of business to implement throughout the rest of this fiscal year which ends in March for MUFG, Toscano said. “We want to continue to take on mandates all around the world and have diverse clients as well as diverse success,” he concluded.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you