ISF Survey 2022 - G2 Borrower rankings

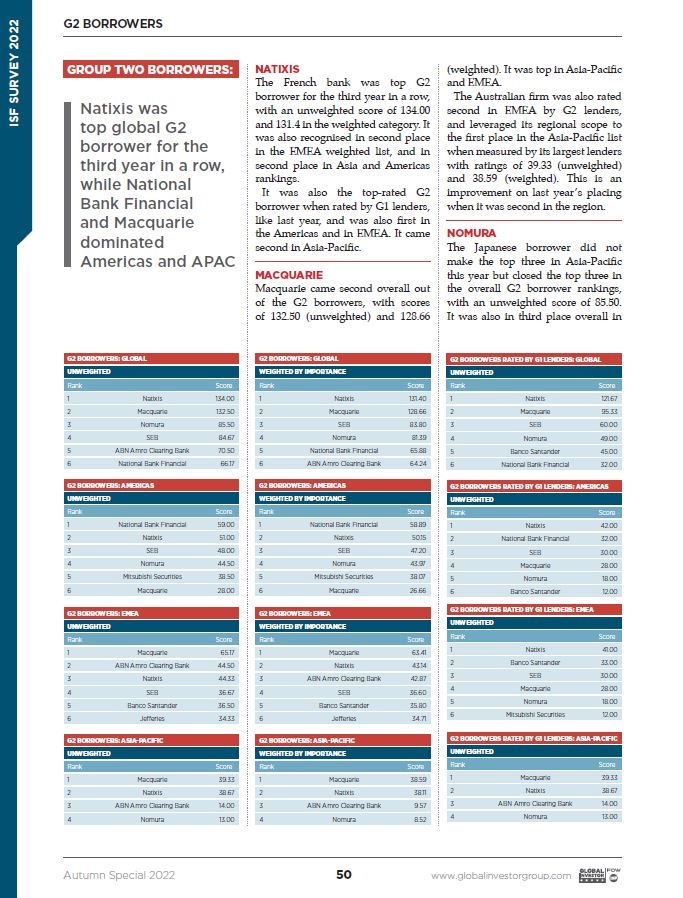

France's Natixis was top G2 borrower for the third year in a row, and was also recognised in second place in the EMEA weighted list, in Asia and in Americas rankings. It was also the top-rated G2 borrower when rated by G1 lenders, like last year, and was also first in the Americas and in EMEA. It came second in Asia-Pacific.

Macquarie came second overall out of the G2 borrowers. It was top in Asia-Pacific and EMEA. The Australian firm was also rated second in EMEA by G2 lenders, and leveraged its regional scope to the first place in the Asia-Pacific list, an improvement on last year’s placing when it was second in the region.

Japanese borrower Nomura did not make the top three in Asia-Pacific this year but closed the top three in the overall G2 borrower rankings. It was also in third place overall in the list rated by G2 lenders and rose to second placed in the Americas in that section of the survey, just behind National Bank Financial.

Sweden’s SEB closed the Americas overall G2 borrower top three group, behind Natixis and National Bank Financial. It was also third in the overall smaller borrower category.

National Bank Financial was top rated in the Americas, ahead of the two European borrowers closing the top three (Natixis and SEB). It was also second in that region when G2 lender ratings were considered.

ABN Amro Clearing was top globally and in EMEA when scored by G2 lenders, the same spots as in 2021, though its score were down in both categories. It arrived in second place in EMEA and in third place in the Asia-Pacific overall rankings, behind Macquarie in both instances. It was also third in Asia- Pacific when rated by its larger lenders.

Japan’s Mitsubishi Securities came top in Americas when voted by G2 lenders, an improvement on last year’s second rank. The borrowing arm of the Japanese firm did not return in the overall Americas rankings this year.

The G2 borrower rankings are part of the ISF Survey, 2022 edition, which can be accessed in the Autumn 2022 magazine here. Equity lender results can be accessed here and here, and part one of the borrower rankings here. We will be releasing fixed income lenders on Wednesday, and tech and data vendors on Thursday.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you