Societe Generale Securities Services doubles down on digitisation

Societe Generale’s custody and fund administration business had a strong year in 2022 despite significant economic headwinds. Societe Generale Securities Services reported revenue up 3.9% in the third quarter to €161m (£141m) while revenue for the first nine months of the year rose 17.3% to €575m.

This revenue growth came despite the French firm’s assets under custody falling 4% in the first nine months to €4.275bn, Societe Generale said in its third quarter earnings.

The increased revenue despite falling assets under custody partly reflects SGSS’ commitment to digital services that draw on state-of-the-art technologies to empower clients.

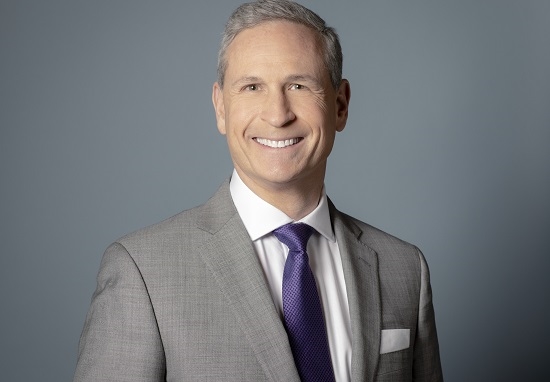

David Abitbol, the head of Societe Generale Securities Services, said the recent success also relates to the company’s geographic focus, on Europe, specifically France, Italy, Luxembourg, Ireland and Germany, and Africa. In terms of clients, SGSS targets asset managers, asset owners, financial intermediaries and broker-dealers, Abitbol said.

More recently, SGSS has been working hard, Abitbol told Global Investor, to support alternative asset managers such as private equity and debt specialists.

He said: “We have seen strong growth over the last few years and this has continued into 2022, reflecting the comprehensive range of solutions that we have built for these alternative asset managers and private market funds. Here, we have also developed advanced middle office services, which allows these firms to outsource part of their operations.”

Asset managers, asset owners and financial firms outsourcing functions to their custodians has been a slow burn in Europe compared to the US but this opportunity is now emerging as clients become more comfortable with digital services and firms like SGSS get better at delivering them.

Abitbol said: “The trend for some years now has been towards more digital solutions, which accelerated through Covid, and outsourcing solutions, as our asset management clients come under strong pressure from clients and regulators. This has led them to look for solutions to improve their own profitability.”

The SGSS chief said its outsourcing services have focused on reducing operating costs and taking care of commoditised functions in the middle and back offices to leave investment managers to focus on what they are good at, that is, investing.

“For some medium sized clients, we have been developing front-to-back solutions, starting from agency execution to portfolio management, trade matching, middle office solutions and so on,” he said.

“Clients are looking for more digital solutions to improve their time-to-market and efficiency. On our side, we are addressing this growing demand and expectations through large investments on technology and data and a profound change in the way we offer our service and how we interact with our clients.”

Abitbol said he is keen to address one area where the custody industry has historically been poor. “One of the most challenging areas is onboarding, especially when clients are coming from other providers, and this is something we have been focusing on, mainly to improve the time and efficiency to enhance the client experience.”

The SGSS boss said European has been slower to adopt these models than their US counterparts because Europe is simply a more complex environment in which to operate.

“For our industry, the situations in the US and Europe are very different. The US has quite homogenous regulation, whereas in Europe it is still very fragmented with different market practices and regulations. This can make the core service and further outsourcing options a different proposition to the US.”

He continued: “That said, I believe the requirements are there and it is up to the asset servicer to offer something that is more efficient, secure, and cost-effective. Digitalisation will accelerate this trend by making outsourcing far easier.”

A potentially powerful technology, of course, is distributed ledger and this is being rolled out in various industry projects to address some of the challenges that SGSS and its clients face every day.

For SGSS, blockchain is part of its global digital asset strategy, Abitbol said: “Societe Generale group has a global approach when it comes to crypto assets. One brick of our offer is in place with our subsidiary, SG Forge, a pioneer in the issuance of crypto assets.

“The latest move has been to develop the crypto custody offer through a partnership. At Societe Generale Securities Services, we are developing the record-keeping service for crypto assets, and we have already onboarded one client, Arquant Capital SAS.”

The crypto assets industry took a massive reputational hit late last year with the collapse of US crypto market FTX, an event that only served to affirm most institutional investors’ innate scepticism about the new asset class.

But Abitbol said: “We are convinced that crypto assets will expand in the coming years and when you look at the pace of the development and the size of the traditional asset management market, we need to ensure that we are offering our clients the access and a bridge between both worlds.”

Events of the past 12 months, including the effects of the Russian invasion of Ukraine on the European energy market, have also posed some interesting questions for the still-evolving ESG market.

But Abitbol is convinced the drive to more sustainable investing is a long-term trend.

“Regulation is urging the industry to work on a common taxonomy, so I don’t see a lot of flexibility in not complying with that. I believe that over time clients will move more and more to ESG types of investments.”

But ESG does have a problem with standards and definitions, Abitbol explained. “When you look across Europe, the ESG criteria differs from one country or asset manager to another, and this criterion depends on the local regulation and client expectations towards investment. It is already the case that ESG doesn’t have a homogenous and single target, the regulation is for everybody.”

Here again custodians like SGSS have a role to play. The SGSS head concluded: “Data is now a key driver for business growth, but it is not yet as well developed as it should. Hence why we have the ambition to further improve the offer for normalised data with the quality that is required for regulatory and client reporting to capture more services and to strengthen the business relationship.”

Abitbol added: “ESG is part of that, but data more generally is key in further developing services for better client satisfaction.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you