Russell Investments on the importance of interim solutions

Stuck between a rock and a hard place?

Chris Adolph, director, customised portfolio solutions EMEA at Russell Investments considers the value of having interim portfolio management expertise embedded in transition management capabilities.

This article is part of the 2023 Transition Management Guide, which can be accessed here.

As long as transition management has been around, there have been clients asking their transition managers to do more than just transition portfolios. The transition manager has extensive trading, operational and project management skills, but at its core we still see transition management as primarily a portfolio management exercise.

As such, it is no surprise when clients approach us asking for advice on what alternatives are available to them if they need to exit an existing investment or manager, but have not yet finalised what will take their place.

There are many reasons why a client might need to exit a manager and performance is often not the principal one. The one commonality for choosing an interim solution is the desire to manage risk while in that transition stage to a new manager (which can take many months) – and if costs can also be minimised during the process that is an added benefit.

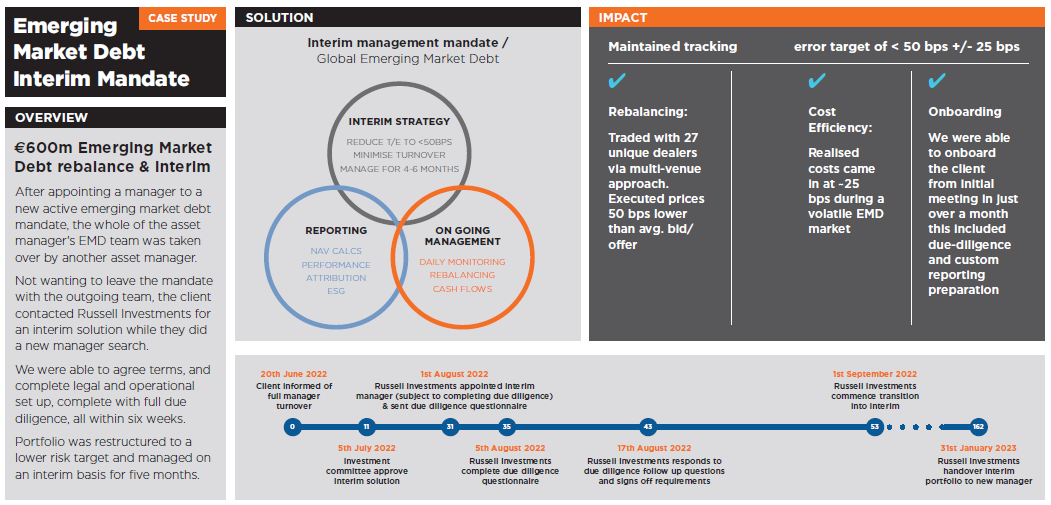

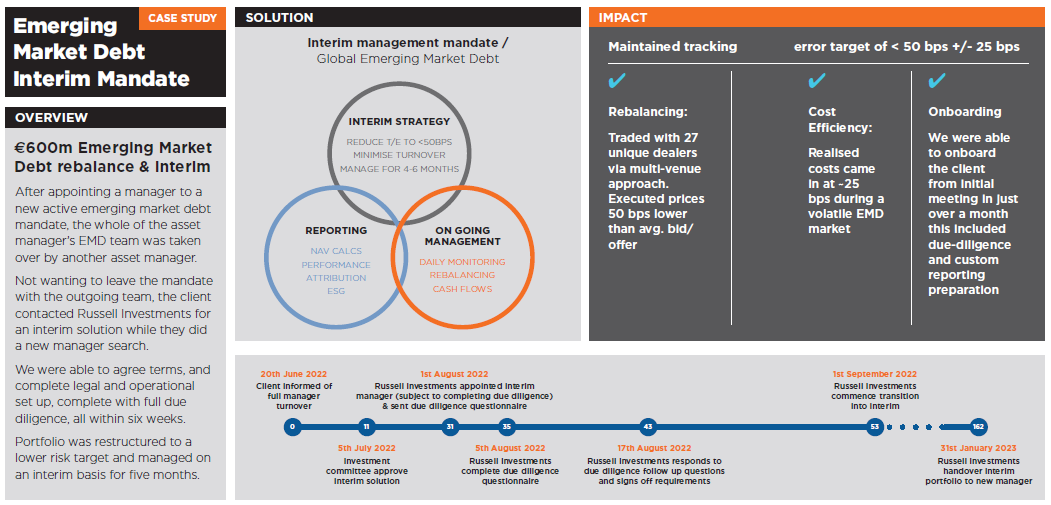

In the case study below we outline the challenge one client faced when, having just awarded an emerging market debt (EMD) mandate to two managers (after an extensive search and due diligence process), one of the managers' entire EMD team was poached by a competitor.

Unwilling to leave the assets with the existing manager, the client approached us to discuss potential interim solutions. Their requirements included reducing risk, minimising turnover (and thus cost), managing to a specific exclusion list, and providing comprehensive reporting - including certain bespoke ESG requirements.

After a thorough, but swiftly implemented contracting and due diligence process on Russell Investments, guidelines and reporting were agreed and the exiting manager’s portfolio rebalanced to a new lower tracking error target.

Thereafter the portfolio was monitored and reconciled regularly and the tracking error kept within the bounds agreed upon. Once a new manager had been appointed and their due diligence completed, the portfolio was handed over.

Conclusion

Clients might choose to use an interim manager for a host of different reasons, but risk management is usually key. However, over and above this, it enables the client to focus on their new manager search and demonstrates to their own stakeholders that not only have proactive steps been taken to manage risk at the total portfolio level, but also that during this interim stage manager fees have been controlled as the active manager fee is replaced by a more passive interim fee.

“We were very pleased with the management by Russell of the interim portfolio. As this was our first experience with interim management, we had a few start up challenges. However, once they had been adequately solved and the interim mandate was live, we could fully focus on selecting a new ‘permanent’ manager. Russell remained proactive during the management of the interim mandate and were able to provide the reporting we needed.”

For professional investors only

This material does not constitute an offer or invitation to anyone in any jurisdiction to invest in any Russell Investments Investment product or use any Russell Investments Investment services where such offer or invitation is not lawful, or in which the person making such offer or invitation is not qualified to do so, nor has it been prepared in connection with any such offer or invitation.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.

The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Past performance does not predict future returns.

The scenario and target presented are an estimate of future performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. What you will get will vary depending on how the market performs and how long you keep the investment/product.

Issued by Russell Investments Implementation Services Limited. Company No. 3049880. Registered in England and Wales with registered office at: Rex House, 10 Regent Street, London SW1Y 4PE. Telephone 020 7024 6000.

Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London E20 1JN. ©1995-2023 Russell Investments Group, LLC. All rights reserved.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you