Part One: Diversifying CME Group

By Radi Khasawneh

Being a global derivatives market at a time of record volumes can be lucrative, but rather than sit on its laurels and reap the benefits of a rising tide CME Group has been busy with transformative projects that are starting to bear fruit.

The start of this decade was marked by huge bouts of volatility and trading activity, which has translated into consistent record-breaking flow into exchange-traded derivatives. FIA data shows that the 10.57 billion contracts traded across global exchanges in March is 54% higher than last year, driven by an 83% boost in options trading to 7.7 billion lots. On a quarterly basis, options trading was up 73% to 20.3 billion contracts.

The CME has certainly benefitted from the hedging demand created by frequent periods of market uncertainty – whether that’s policy driven rates sentiment or the knock-on effects of funding concerns in the sector.

This period last year included trading around the Russian invasion of Ukraine, and yet options have set a new all-time volume record of 5.8 million contracts traded a day in the first quarter of this year. That has meant CME Group recorded an all-time high of $218 million (£174.8m) in revenue from its options business in the first three months, according to its results filing in April.

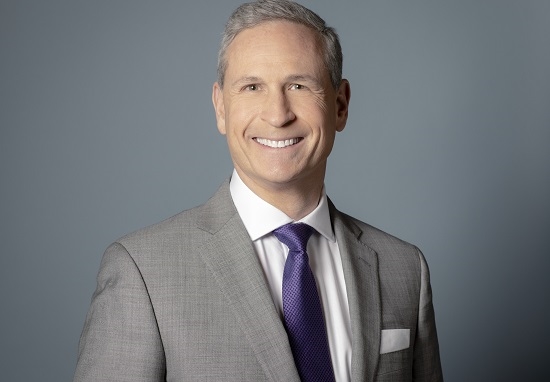

Derek Sammann, senior managing director and global head of commodities, options and international markets at CME Group, says that, rather than being a product of its natural position at the centre of some of the most widely traded benchmarks across asset classes, the continued outperformance is the result of a deliberate expansion in the flexibility of its contracts over the last five years.

“Options are just purpose built for the kind of markets we are now facing, with uncertainty concerns driving volumes around both short and long-term maturities,” he told Global Investor. “We have certainly seen increasing customer demand for short-dated options to complement our monthly and quarterly expirations over the last year.

“Going back five years ago, customers could really only trade quarterly options, but that's a lot of premium for traders to absorb. So we continued to develop shorter date expirations across the board because they are such a great tool for people’s portfolios which is a major reason why we set a new volume record for weekly options in the first quarter. I don't personally think that daily expirations in every asset class is going to be the natural outcome, but we have certainly significantly added to execution flexibility and that’s been reflected in the record options volumes we have seen.”

Ever since Covid-related surges in equity derivatives – amid talk of meme stocks and huge demand in the US for ever smaller contracts – there has been an assumption that the growth in options trading has been driven by retail flow. Sammann says CME Group has actually seen institutions take a larger block of that demand as they look to capture the relative cheapness and flexibility of options in the current environment.

“It’s important to note that this has also meant record levels of participation across the board - buy side has been our biggest growth driver followed by corporates,” he added. “That tells you that it’s driven by end users taking term positions and managing risk for explicit dates. Options are becoming a bigger portion of customer portfolios.

“What we like to see is volume and open interest growing across the entire maturity curve, with end-user customers carrying positions, not just looking to trade in and out on the same day. That's where I think there's a difference between just focusing on the front-end versus looking at your term liquidity and where and how customers are carrying their positions.”

The end of Libor

One monumental task facing the CME has been its role in the transition from US dollar Libor, with mandatory cessation of the rate for new contracts at the end of June. The exchange launched its first Libor-referencing Eurodollar contract in 1981, and has been the dominant force in the market for decades.

Results calls over recent years have been characterised by persistent questions over the transition to the “risk free” Secured Overnight Financing Rate (SOFR) preferred by US regulators. In the event, the exchange has managed to retain and even overshadow Eurodollar numbers ahead of schedule. The first quarter saw a record 5.2 million contracts a day traded in SOFR futures, higher than the Eurodollar peak. March also saw combined futures and options average daily volume (ADV) overtake the Eurodollar record for the first time (see chart).

“Within the interest rate complex, our main focus has rightly been on shifting the balance of our Eurodollar business to SOFR contracts,” Sammann said. “That has been a great success, extending into our conversion processes which has gone incredibly smoothly.

“Our greatest concern going into this was seeing a reduction in open interest, but the story has really been an almost instantaneous conversion of that open interest, and if anything the Eurodollar/SOFR complex has so far outperformed treasury contracts because there has been so much focus on the short end of the curve. The SOFR transition has not limited or inhibited that in any way and that is probably the greatest compliment we can pay to the way a process of this magnitude has been managed.”

For the CME, the weekends of April 15 and 22 marked the conversions of listed and over-the-counter US Libor referencing rates contracts. In a process timed to coincide with rival and dominant OTC interest rate swaps clearer LCH’s own process, CME Group has now successfully switched 7.5 million Eurodollar contracts and $4 trillion of swaps – effectively drawing a line under the years-long process for the firm.

Along with a swathe of Libor conversions globally across currencies, the changes tie in with a process that began for the firm in 2006 – the transformative merger of the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). Most recently, the firm in October started trading its three month euro short term rate (€STR) referencing contracts, launching with related spread and basis contracts.

“That ties into the industrial logic of bringing together CME and CBOT originally, which was predicated on the idea of bringing the whole yield curve together in one place and allow people to trade the curve spreads,” Sammann says. “So for us, we're always looking at ways to do that and it ties directly to our themes of creating operational efficiencies and capital efficiencies for our customers. We want to put the additive tools inside the portfolio to make it as efficient as possible and release synergies for our customers’ portfolios. If you put that on the same platform that's where the magic happens.”

The CME racked up more than 80,000 lots in the complex within four months – far outstripping the more recent and lightly traded Eurex version of the European risk-free rate. Europe’s more established Euribor contract will continue to exist, unlike other regions, meaning a more fragmented liquidity picture.

The second part of the Derek Sammann interview will be published on May 9.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you