Part Two: Diversifying CME Group

In the second part of a two part series, Radi Khasawneh talks to CME Group's Derek Sammann about new product opportunities at the huge US exchange group

Continued from Part One on May 4

The volatility in energy markets, by contrast, reduced volumes across the sector as margins suffered from elevated pricing driven by geopolitical constraints and supply shocks related to Russian policy and sanctions. The CME has a West Texas Intermediate (WTI) crude oil contract which is a key bellwether for global markets.

Derek Sammann, senior managing director and global head of commodities, options and international markets at CME Group, says there are positive signs emerging as exchange-traded fund (ETFs) issuers and financial participants return to the market.

“Within energy what we have seen is a recovery from lows in the middle the fourth quarter,” he added. “To give you an example, open interest in WTI has bounced back up to 1.9 million contracts, so we added roughly half a million contracts in the first quarter. And that’s coming from ETFs which you can see in the roll data. That’s a good sign of an allocation of positions back into crude oil, and we find that encouraging. Everyone has a role to play in maintaining a healthy market there, and we’re seeing a more diversified mix of participants coming back to the market.”

CME Group's position in energy market grows out of its takeover of the New York Mercantile Exchange (NYMEX) in 2008, a deal which also saw the acquisition of a metals business (COMEX).

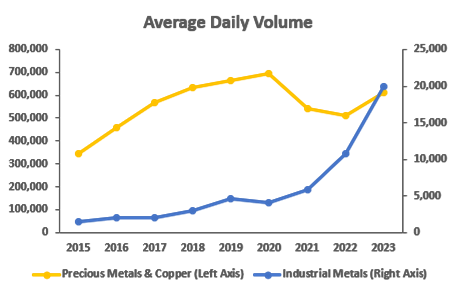

“Since we bought NYMEX and COMEX in 2008, what we have managed to do is really build out the base metals business and that has accelerated over the last five years,” Sammann adds. “A prime instance of that is the stunning success we have had building out the copper franchise. Our entry there was a need to build a product that dealt with the problem of an unhedgeable basis with the US copper market at that time. More recently, our approach on markets like Aluminum has been very much the same, with the issues around the market structure of some physical delivery markets, we have seen an uptick in brokers using COMEX products that have never done so before and would likely not have done that.”

With issues around the operation of the main physical metals market – the London Metal Exchange – still in the process of being resolved after an unprecedented suspension of its Nickel market in March last year, the CME has seen more interest from its highest tier market-makers (Cat 1 members) connecting to COMEX for its largest contracts, presenting a huge opportunity for CME, Sammann says.

“With the footprint and credibility we built in our Copper business, we are now attracting Cat 1 members, brokers and traders who are adding COMEX products, specifically Copper and Aluminum and that has driven record volumes, open interest and participant rates,” he added. “Increasingly, physical customers are telling us they need an alternative and we've stepped in and built differentiated products with the right infrastructure, known rules and the deterministic market behaviour that consumers need.

“They need certainty on how trades are processed, how trades are cleared, and how money flows. Moving physical markets is a slow process, and it’s a multi-year project to become an accepted but the percentage growth we are seeing is really compelling.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you