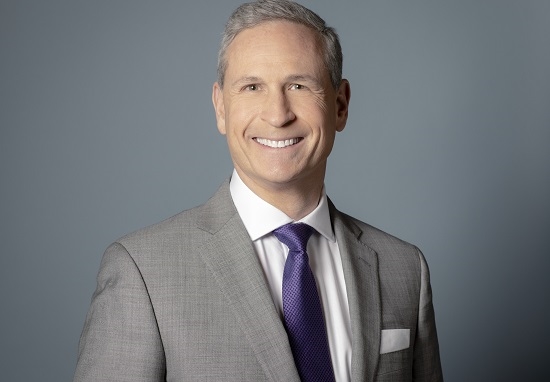

Part Two: Persefoni chief Kawamori discusses green-washing, regulation

In the second part of a two-part series that started on May 10, Persefoni founder and chief executive Kentaro Kawamori tackles green-washing and changing climate regulation

Asked about allegations of green-washing last year against the asset management divisions of leading investment banks, the Persefoni chief said it is too easy to blame those firms, rather there are other issues at play.

“We have some of the largest European, UK and US banks as clients. These banks are dispersed and don’t really talk to each other, so where we have seen examples of greenwashing, it wasn’t necessarily a systemic issue in the bank because they operate so independently of each other.

He added: “If you look at the asset management arms of those banks, I’d say they are 50-50 at fault. So, 50% is on them because they should have done more due diligence and shouldn’t have put green labels on everything. The accountability wave has come quickly; however, they should have been more diligent. The other 50%, however, is on some of the large data providers in this space that sell massive amounts of climate and ESG data.”

And this is where Persefoni comes in.

Kawamori said: “Every carbon and climate analytics package on the planet is derived from one data set called CDP, which is a non-profit voluntary register for corporates to report their carbon footprint into. The founding chair of CDP sits on our Sustainability Advisory Board, and we know them well.”

“The problem with the data set is that it is unverified, so a corporate can simply report their number, but there is no level of assurance or audit that proves the number is correct.”

He continued: “However, every vendor who has a data analytics package they sell in this space uses CDP as the derivative data. So, you immediately see the problem that we are using this low fidelity data set to make all these assumptions and build these models.”

Kawamori sees a role for Persefoni here as it has authenticated data on firms’ carbon emissions.

“What will happen is companies like Persefoni will replace CDP’s data set because we have the actual data from companies - they bring in the activity data and do hyper-granular calculations on our platform. We will anonymise and publish that and replace CDP’s data set at scale. That is one of the paths we are undertaking over the next few years.”

Kawamori said this process will “unfortunately” take at least another three years to build out the data set to the scale required to be considered high fidelity.

That said, Persefoni data covers today some 220,000 unique investments linked to about 15,000 unique entities so the set is large and growing, he said.

Rules and Regs

The regulation referring to climate disclosure is complex and varies across jurisdictions. The US equities regulator the SEC is set to finalise in the coming months its Climate Disclosure Rule based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Kawamori sees these proposals as “the least stringent disclosure regulation” compared to the European Union’s Corporate Sustainability Reporting Directive (CSRD) first proposed in April 2021.

The regulation is dense and layered, the Persefoni chief added. “Under the regulatory frameworks being pushed by the SEC and CSRD, the financial services sector automatically has liability because of the way that they are adopting the standards. Then you have the TCFD, that’s the UN G7 accepted framework for financial services customers. Within that, one of the questions is around disclosing your carbon footprint for which the guidance dictates that they use the greenhouse gas protocol. Then, when you go a layer deeper, you have another protocol called PCAF, which is the only financed emissions accepted accounting framework under the Greenhouse Gas Protocol.

Kawamori added: “The SEC and CSRD say you must be scope 3, so automatically if you are a financial services company, scope 3 category 15 is financed emissions, so it triggers an automatic coverage that they must start disclosing their activities.”

Under the current rules, investment firms are not required to report climate emissions for every investment or even every fund but, in effect, that is where they are because that is what investors demand.

Kawamori said: “It’s technically voluntary if you look at it through a regulatory lens, but if you are a GP raising capital, it’s not necessarily voluntary. Today, it’s moving into investment and even debt covenants.”

The Persefoni chief cited the example of Canadian pension funds that through their private equity arms expect firms using their private credit to disclose in detail their carbon footprint.

Landmark SEC regulation

The potentially landmark SEC proposal has, however, been subject to vocal opposition from a handful of US politicians and companies, a lobby group that Kawamori takes seriously.

He said: “There is no doubt that US opposition has the potential to affect the US proposals. The fact remains that the US is the only country in the world where climate change remains a contentious issue. Nowhere else would you hear people say: “No, this is a bad idea, we shouldn’t address it.”

The Persefoni chief said the lobby may be relatively few in number but its high profile reflects its spending on Capitol Hill.

“I think the biggest risk is that in this next election cycle, if these people get somebody who decides to make this a platform in the presidential run, then this message is going to get amplified. There is a significant risk in that,” Kawamori added.

He concluded: “The SEC ruling being finalised will give us a first glimpse of how serious is that opposition, that is, were they successful in watering it down or eliminating it entirely? I don’t think it will be, but we are obviously watching it closely.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you