Part Four: LSE Group’s post-trade strategy moves to the fore

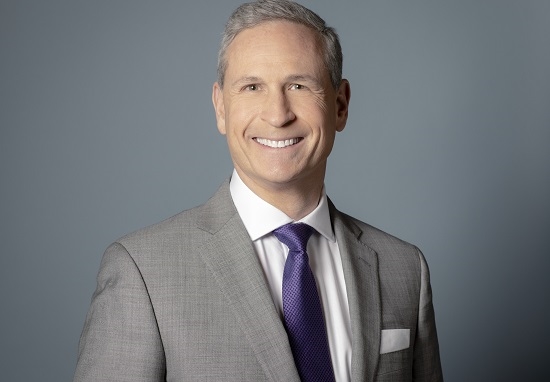

In the last of a four part series this week, Daniel Maguire, the Group Head of Post Trade at London Stock Exchange Group and Chief Executive Officer of LCH Group, considers foreign exchange and cryptocurrency clearing

Alongside swaps, repos and credit, LCH’s other significant derivatives clearing market is foreign exchange. Launched in 2012, ForexClear has also benefitted from regulatory change in the over-the-counter derivatives market.

Maguire said: “If you look at the FX product set – NDFs (non-deliverable forwards) and FX options are subject to UMR – NDFs are seeing real growth in terms of dealer-to-dealer and dealer-to-client activity, particularly in APAC and LatAm currencies and there we are seeing month-on-month growth, which is helping us pick up a lot of customers in the APAC region.”

The LCH chief said ForexClear cleared $2.2 trillion of NDF notional in March 2023 alone while the first quarter was 35% higher than the previous record quarter for client NDF volumes.

He continued: “In October this year, LSEG will launch the NDF matching platform in Singapore. The integration of clearing into the NDF matching platform means that customers can decide on a pre-trade basis to clear their NDFs. Margin savings and operational efficiencies will be key benefits of this service – we’re really looking forward to supporting customers as this market continues to grow and there is a lot of interest in this innovation.”

Maguire added: “The second thread is FX options (and associated hedges) where we are connected to CLS for physical settlement and there we are also seeing volumes and the number of participants growing month-on-month at a pretty high rate − this is driven by both margin and capital benefits.”

LCH reported in the first quarter of this year three successive record months for FX options and set on April 4 a daily volume record of €14.8bn.

“We have approximately doubled our volumes over the past year and expect to do so again in the next 12 months, with a number of major global banks activating in the next few months.”

In line with LCH’s strategy to offer more products and services in the less standardised, uncleared end of the derivatives market, the LSEG post-trade business is focusing on delivering capital efficiencies in FX forwards and FX swaps, drawing on the unique capabilities of its various businesses.

Maguire said: “FX forwards and swaps are really important because these products are subject to capital requirements under SA-CCR.”

LCH has developed something it calls Smart Clearing, supporting customers’ capital optimisation needs by clearing selective portfolios of FX forwards, without increasing margin excessively.

“Essentially what we have done is, with their agreement, analysed various banks’ and buy-side firms’ FX forwards and swaps books, run an optimisation simulation through Quantile so we can take portfolios of relatively delta neutral FX forwards, and put them into ForexClear where we can net down the exposure and manage the initial margin within constraints.

“In addition, any residual uncleared risk can be swept into SwapAgent to further streamline the exposure and capital management process. So, this is supporting customers across the cleared and uncleared space and leveraging Quantile’s services across both.”

Foreign exchange is another market where Maguire sees the opportunity to offer services that straddle the cleared and uncleared divide, offering efficiencies across two correlated businesses that are currently managed separately.

He said: “FX has been and is a long-term play for us. We are seeing good growth in NDFs and options but now, with our capability for customers to be able to ‘toggle’ between cleared and uncleared dependent on their preferences and goals, we have the tools to make these currently uncleared products much more capital and margin efficient and, by extension, more operationally efficient too.”

LCH goes “crypto”

The point of a clearing house like LCH is to mitigate risks on behalf of clients and the industry at large; these are highly risk-averse businesses by nature. So, it was somewhat surprising and at the same time entirely appropriate to learn that LCH is set to foray into the most volatile of all asset classes - crypto-currencies.

LCH SA said on April 13 it had reached agreement (subject to regulatory approval) with crypto market GFO-X to start clearing bitcoin futures and options traded on GFO-X when it goes live, slated for the fourth quarter of this year.

GFO-X represents LCH’s first crypto-currency client and the clearing house has set up to support GFO-X a new division called LCH DigitalAssetClear, which sits within its Paris-based clearing house LCH SA.

Maguire said: “We are also looking at how can we take the apparatus, regulatory approvals and technology we have to work with alternative trading venue partners to launch existing and new listed derivatives products and services.”

Maguire is quick to stress that LCH DigitalAssetClear is fully segregated from the other clearing services already in operation, so there is no chance of contagion between the crypto-currency pool and ForexClear’s or any of the other default funds.

GFO-X and LCH are also keen to stress that they are fully-regulated, institutional-grade entities, an attribute that sets them apart from many of the existing crypto markets.

Maguire said: “The offering has been developed in close consultation with market participants, to ensure their digital asset derivatives trading and clearing requirements can be met within a secure, highly regulated, prudent risk management environment.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you