Part One: SGX Group chief Loh discusses evolving Asian opportunities

By Luke Jeffs

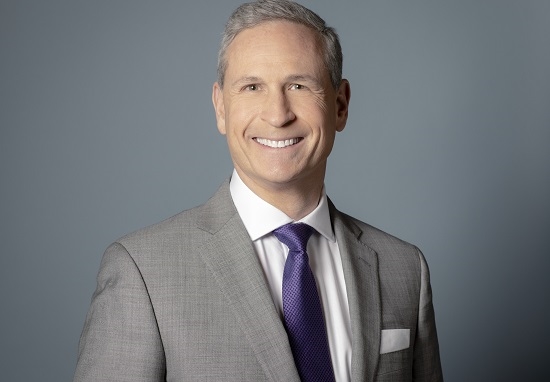

Loh Boon Chye will celebrate in July 2023 eight years as the chief executive of SGX Group and he can be rightly pleased with the progress the Singapore exchange has made in that time.

SGX reported for its 2022 financial year (which ran to the end of June last year) record operating revenue of S$1.1bn (£659m), up 4% on S$1.06bn in the previous 12 months, driven largely by higher earnings in equities, currencies and currencies.

The first half of the current financial year has continued this theme with revenue in the latter half of last year up a tenth on the same period of 2022 to S$571m, partly reflecting a 28% spike in derivatives revenue.

The half year earnings were the exchange group's best since SGX started financial reporting after listing in 2000.

Speaking to Global Investor in April, Loh Boon Chye said the group’s recent record financial performance reflects the diversification strategy implemented by the firm over recent years.

“We had a strong 2022 and we have had a good start to this year. As an exchange group, we have now transformed ourselves into a multi-asset platform that, as an international exchange, offers unrivalled access to Asian economies and Asian markets through equity index derivatives, currencies and commodities.”

The breadth of the group is obvious in its latest full-year revenue results: 23% from fixed income, currencies and commodities, 29% in equity derivatives, 35% from cash equities and 13% from data, connectivity and indices.

Another of Loh’s strategies is to establish SGX as the international gateway to Asia’s fast-growing economies including China, offering investors from outside Asia a secure platform for investing across the continent.

Loh said: “Asia is not a homogenous region, it is made up of many countries that have grown in the last 15 to 20 years relatively faster than the global economy. Having been able to position SGX Group as the trusted platform for accessing the Asian markets, we have also been able to broaden and deepen our asset-class offering.”

He added: “We, as an exchange group, essentially simplify Asia for international investors who are seeking investment opportunities in this part of the world or are actively managing their portfolio that includes Asia.”

And the two strategies are complementary because of the way that international traders increasingly manage their Asian exposure, switching between correlated instruments to maximise their return.

“If you trade the Asian markets, you might be moving in and out between foreign exchange, commodities or equity derivatives. So for every one dollar of risk capital posted with SGX, the correlation of the different asset classes allows us to stretch that further, so that is why FX has grown alongside some of our other asset classes such as equity index derivatives,” said Loh.

Foreign Exchange

The SGX chief executive officer is especially pleased with the progress the group has made in foreign exchange (FX) derivatives, a vast over-the-counter market where exchanges have historically struggled.

He said: “In foreign exchange, we are the world’s leading exchange for listed FX derivatives in Asian currencies and we have broadened the value chain to include over-the-counter FX.”

And this is potentially only the beginning for SGX in what is a dynamic asset class.

“The opportunities in FX are enormous. We have been able to grow our listed FX derivatives business in the last ten years through the zero-interest-rate regime, so the relative movements of currencies were predicated on the expected movement between two currencies based on the fundamentals,” Loh said.

“With interest rates at their current level, FX has become an asset class in its own right because it does offer a yield. In the Asian equity markets, FX movements can accentuate positively or negatively your equity market return.” The chief executive also said the exchange is looking at options on some currencies to accelerate the growth in its FX segment.

Equity Derivatives

By volume, SGX’s most popular product remains the FTSE China A50 Index future which last year traded over 100 million lots in a single year for the first time when 103 million contracts were traded. This was up 5.6% on 2021, meaning that the A50 made up last year 40% of SGX’s futures trading book by volume, according to the exchange.

Loh said: “When we look at our A50 futures, the contract has really grown in relevance for international investors to invest in the Chinese economy and the Chinese equity market. In terms of China exposure, we offer not just A50 futures but also our market-leading CNH FX futures and pioneering iron ore derivatives.”

The increase in trading volume last year can be attributed to ongoing concerns about the future of the Chinese economy given its protracted Covid restrictions but the outlook is more positive now.

The SGX chief executive said: “When we think about China’s reopening, market participants are optimistic that the reopening is a catalyst for growth. Singapore and SGX Group are well-positioned in that regard. That said, Asia is more than China. China is a critical part of the region’s future, given the size and the growth of the economy, but we also have India where the economy has proved to be resilient and GDP has been growing at near 6%.”

The Singapore Exchange is bullish on India where the group will commence full-scale operation of the NSE IFSC-SGX Connect in July with the transition of its Nifty 50 futures contract to GIFT City.

Loh said: “We have also broadened our equity index derivatives through the upcoming launch of our GIFT Connect platform with our partner the National Stock Exchange of India that will bring together the international liquidity that we offer on the Nifty contract with the domestic liquidity.”

The SGX Nifty Index future traded almost 30 million lots last year, making it the exchange’s second most popular listed derivative behind the A50.

To be continued on May 24

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you