S&P Global: Control, Monitor, Understand

S&P Global: Control, Monitor, Understand

Monica Damas-Shaw, Head of the US Beneficial Owner Product, S&P Global Market Intelligence.

This article is part of the 2023 Beneficial Owners Guide, which can be accessed here.

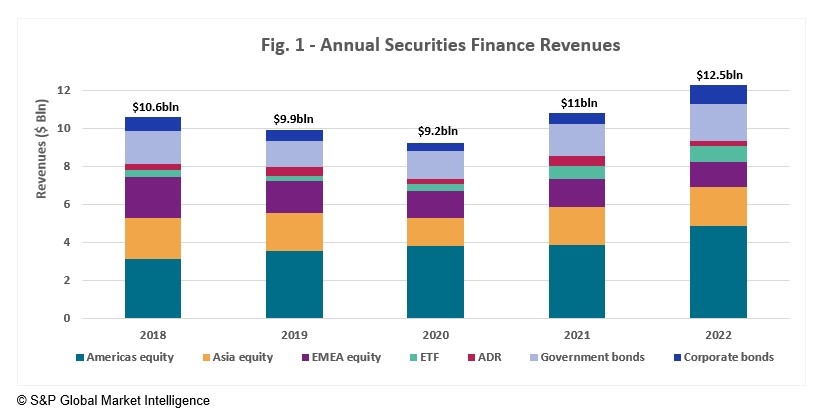

2022 was a year marked by market volatility, geopolitical risk, investor uncertainty, and a sharp decline in asset valuations. The securities finance markets offered a counterbalance to the fall in investment returns over the course of the year, as 2022 generated the second highest securities lending revenues since 2008. During the year, the securities finance market generated revenues of over $12.5B (see Fig 1), with over $10B going directly to lenders. This increase of 9% YoY reflects favorable market conditions for securities lending (volatility often provides multiple opportunities for market participants) and a beneficial owner community that has become more engaged and more informed than ever before.

As market valuations and the use of passive investment strategies have increased over recent years, so has the number of market participants engaging in securities lending. After hitting an all-time high of $37 Trillion in 2021, the value of lendable inventories fell throughout 2022 to a low of $29T at the end of December, while the average value of available assets over the year was $31T. As we looked at the client breakdown (see Fig. 2), asset managers were the largest contingent of the lender base owning just over 57% of the total lendable assets available in the market (equating to just over $18B). Pensions funds were the second largest contingent, with just over 19% of all assets, followed by Sovereign Wealth funds (11%) and insurance vehicles (5%).

Despite having a smaller lendable inventory, our data shows that pension funds, as seen in Fig. 3, had the greatest proportion of their assets on loan over the year, 36% ($850.2M) in 2022, falling from 37.2% ($892.6M) in 2021, followed by asset managers, 24.53% ($578.9M) compared to 24.13% ($578.8M) in 2021 and Sovereign Wealth funds, 24.45% ($577M) in 2022 vs 22.87% ($548.7M) in 2021. Insurance vehicles contributed just over 5% ($132.7M) of all on loan balances. Average on loan balances were $2.36T over 2022, a slight reduction from $2.39T over 2021.

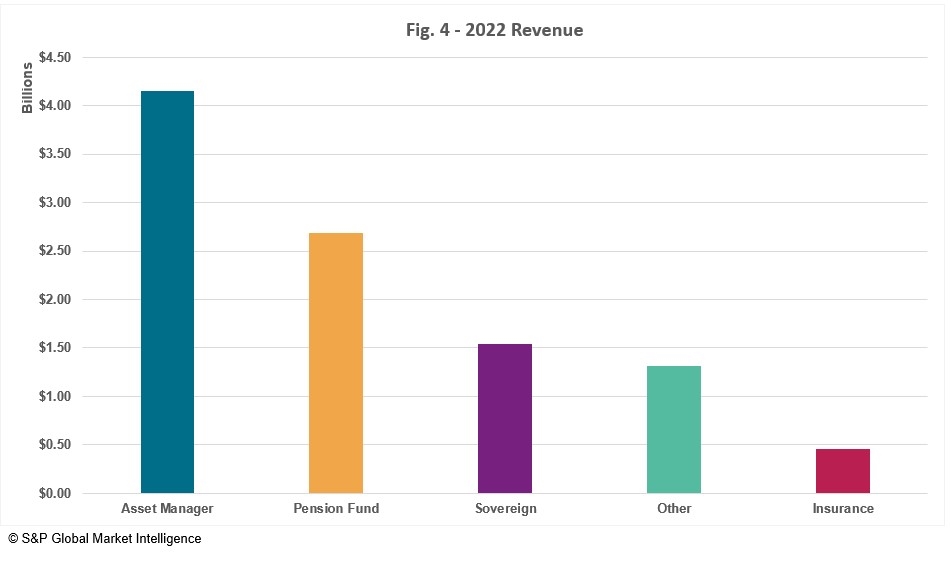

Throughout 2022, revenues increased across the lending community, which was positive for investment portfolios. Asset managers received the largest share of the lender revenues over 2022 ($4.2B vs $3.4B in 2021), even though they had less on loan than pension funds which generated ($2.69B vs $2.42B) and sovereign wealth funds ($1.5B vs $1.1B in 2021). Insurance vehicles generated $450m in revenues over the year ($436.4M in 2021), as seen in fig. 4.

Over the years, securities finance has become an integral part of the investment management process. Risk management has become an increasingly important consideration for all beneficial owners as they seek to protect both their revenues and investors in a new era of higher interest rates, increased volatility, and greater uncertainty. As the industry has changed, the increase in engagement across the beneficial owner community has been initiated by a fervent desire to better understand the tools and processes required to optimize performance, oversee compliance, manage risk, and minimize opportunity costs.

At S&P Global Market Intelligence Securities Finance (SF), our current focus is the introduction of solutions-

based capabilities where we combine data and analytics to provide transparency and tools, so that clients have a better understanding of how their programs are being run. We have done this by focusing on three separate pillars we believe are essential to the oversight and management of any securities finance activity: control, monitor and understand.

Control

Many beneficial owners lend through their custodian or a third-party agent. When lending through an agent lender, any direct control that an owner has over their assets is transferred to the lending agent. Therefore, it is particularly important that a robust framework is in place that dictates the terms and conditions in which an agent lender can engage when lending a security. Many of the program parameters are negotiated through the Securities Lending Agreement (SLA) with the lending agent, these should be reviewed regularly to ensure that any new market initiatives or workflows are being captured. Regular reporting should be required to ensure that the agreed conditions are followed. It is also advisable that these conditions are captured by an internal securities lending policy to ensure that all internal stakeholders are aware of the lending structure. As seen throughout the past year, effective and timely reporting remains essential in managing and identifying potential risks.

Monitor

Active monitoring of the securities lending activity is essential to ensure that risks are managed, and revenues are optimized. The monitoring function for a beneficial owner can be split into three different areas: Exposure, Exception Management, and Liquidity Management.

Managing exposures should occur across lending agents at the counterparty legal entity level and collateral holdings level (credit ratings, maturity buckets, liquidity profiles). Overseeing this requirement across different lending vehicles and agents can sometimes be both complex and cumbersome. As part of our offering, we provide access to consolidated reporting and a portal to give asset owners a holistic view of their programs.

Exception management lies at the heart of any oversight function. A clear and timely process to identify exceptions is critical for effective risk management and program governance. These checks should be made daily to ensure that any potential exceptions can be addressed promptly and that the program is not assuming additional and unauthorized risk. With an increase in both the quantity and type of regulations affecting securities lending, having an appropriate and effective exception management process allows asset owners to both recall and efficiently restrict assets, and to be aware of any opportunity costs that may exist as a result. To address the need for beneficial owners to independently monitor adherence to agreed lending parameters, we launched a Compliance Check portal for beneficial owners. The portal provides an exception-based tool to identify potential breaches of lending parameters at the transaction, instrument, market, and counterpart level.

Equally important to any lending program is understanding the liquidity profile of their loan positions. We also provide liquidity data to assist with the efficient management of lending limits and identifying any potential market liquidity squeezes.

Understand

All beneficial owners should have a deep understanding of the activity taking place across their asset pools and understand how this can be either expanded or contracted if their risk profile is adjusted. A securities lending program’s earnings potential is often linked to its appetite for risk and therefore, appropriate benchmarking is considered the best practice. As was seen during 2022, the “specials” market (stocks being lent at a fee greater than 500bps) has become an important driver of revenues for many asset owners. Having a clear understanding of these rates, the liquidity risks associated with lending these positions and the potential revenues should any of the metrics be adjusted, remains critical to optimizing a lending program. We offer extensive reporting and access to relevant data for proper oversight management.

S&P Global Market Intelligence has developed several tools that are specific to beneficial owners to assist them in meeting the challenges listed above. These tools are proving popular across the beneficial owner community as volatility remains a key feature across all markets.

Looking towards the spring and summer months, we believe that securities lending revenues will remain robust. We also believe that the first half of 2023 has the potential to produce strong returns for beneficial owners. To ensure that a lending program is participating in these returns in a risk-adjusted manner we encourage all beneficial owners to consider many of the controls that have been mentioned. As our engagement with beneficial owners continues to grow, we believe that S&P Global Market Intelligence is well placed to independently assist and advise the beneficial owner community on the best way of achieving their securities lending goals.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you