Part One: Pictet Asset Services chief Briol sets the scene

By Luke Jeffs

Pictet is one of the most trusted financial services brands on the planet which counts for a lot in a year when some banks, including another famous Swiss name, have found themselves in trouble.

With over half a trillion of assets under custody, Pictet Asset Services is big enough to be relevant but much smaller and, therefore, nimbler than some of the world’s largest custodians that count their client assets into the tens of trillions.

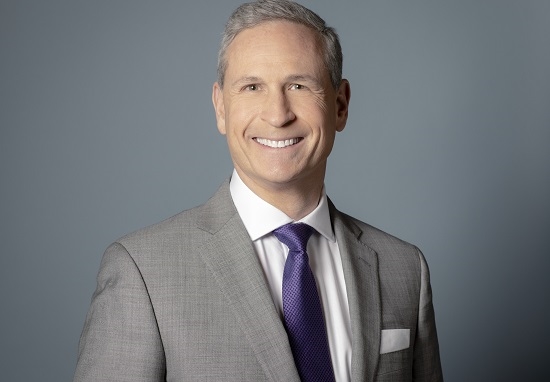

For Marc Briol, Chief Executive Officer of Pictet Asset Services, however, this is very much part of the story – differentiation by quality of service rather than scale.

Speaking in London at the end of April, Briol told Global Investor: “We want somehow to be a predictable nice surprise, in the sense that people know what they get from us, which is a division focusing only on active investors. We want to be known as the European asset servicing boutique for active investors.”

Pictet Asset Services is one of four divisions that makes up the Switzerland-based Pictet Group, with Wealth Management, Asset Management and Alternative Advisors.

The asset services arm draws on the Pictet tradition of actively managing investments: “Active investors are key. That is our legacy and heritage because that is where we come from, we are active investors ourselves so we think we have some proximity with active investors whether for private clients or funds.”

But Briol is keen to stress his division is ring-fenced from the other businesses, which the chief executive said makes it a “pure play provider”. “This model has the advantage of being completely clean in terms of conflicts of interest in that we are mutually exclusive, which is a very different positioning from our competitors. I respect their business model but we think it’s complicated to explain to a talented fund manager or private banker that he is being serviced by his competitor. This is not the case with Pictet Asset Services.”

Briol said there are no cross-subsidies between Pictet Asset Services and the other divisions of the group: “We position the offering at arm’s length.”

“From that perspective, the strategy will remain the same. We would also not contemplate taking over parts of competitors that would potentially exit some markets or segments. We would always tend to prioritise organic growth.”

European focus

In terms of geographies, Briol said Pictet Asset Services is strong in French-speaking Switzerland and is making a push in the UK, German-speaking Switzerland, Paris and Monaco, partly for opportunistic reasons. “A lot of our competitors have exited the market,” said Briol.

“If you think about the UK, there were major competitors who have, for very good reasons, refocused their efforts on other regions or segments. So we have positioned ourselves as an interesting alternative for managers who need some diversification for reasons of counterparty risk.

He added: “We are in London today and the number of talented managers you have here is just amazing. There is a lot we can do here, while there is a lot that we can improve on our platform to be more competitive. We will be proposing ISA by the end of the year, which is a key requirement for fund managers here.”

Briol added: “The Pictet brand is our best salesman. We can capitalise on the excellent reputation established by asset management and wealth management for example. It is part of the coherent values that we apply in the asset services business.”

In response to the question “How do you compete with the massive US custodians that spend billions on IT?”, Briol said: “People may say we’re too big for someone or too small for others but what matters is that we have the critical size to be credible and to be able to invest in the platform, technology and people but we are still small enough to remain agile and be able to listen to our clients.

“To paraphrase our senior managing partner: “We don’t want to be the biggest but the finest”. There is a profound truth in that, in the sense that we must be credible for clients and I think we are. The awards that we consistently win show that we are consistently doing a reasonably good job.

“That said, technology is a must-have but it is not enough. Technology for the sake of technology is not interesting. One of the things we hear from clients is that they like the fact that our platform is good and that it is not changing every year. Another comment I find interesting is: “When we call you someone answers the phone” which shows that at some point, beyond a certain scale, it is difficult to keep the clients’ attention,” he added.

To be continued on May 31

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you