Part Three: Pictet Asset Services CEO Briol on ESG investing

Continued from Part Two on May 31

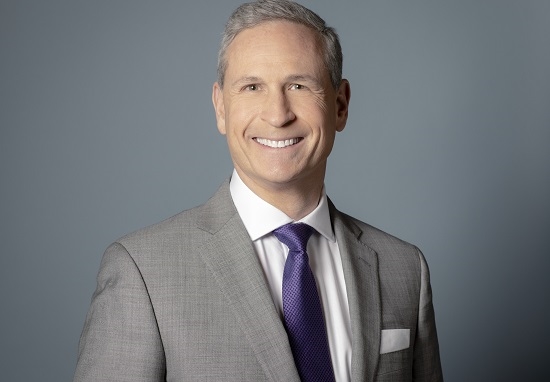

As a financial services firm of more than 200 years’ standing, Pictet is a strong exponent of sustainable investing. Marc Briol, the chief executive of Pictet Asset Services, said his firm is working hard with its clients to help them meet their environmental, social and governance (ESG) objectives.

He said: “We are convinced that ESG matters. Our firm is committed to the idea of longer term investing based on resilience. ESG ties in social as well and we have talked about staff retention which is a core part of our ESG values.

“For institutional investors, we provide all the reporting and advise around how they can comply with the regulations, particularly in Switzerland where we are dominant in the institutional segment. In Luxembourg, we engage with all the Article 6-8-9 and that’s where the added-value starts.”

Articles 6, 8 and 9 are the most commonly used fund classifications under the European Union’s Sustainable Finance Disclosure Regulation (SFDR), with Article 9 being the most demanding.

Briol said: “Typically, we engage in discussions with clients and we did have some tough discussions with clients at the outset because all clients wanted to go to 8 or 9, and we had those conversations where we thought that may not have been a good idea because of their investment style. In effect, we had a lot of clients that went for something else, namely a lower score, which I think was good for them.”

Pictet Asset Services offers the standardised ESG reporting that firms require and has worked also on various ESG research projects.

“There is an initiative that we supported in Switzerland called Enterprise for Society with the Swiss Federal Institute of Technology Lausanne (EPFL), the University of Lausanne and IMD Business School to set up a new centre to think about the impact of climate change,” Briol said.

“We subsidised an academic paper on what we think of important themes such as: “Is it better to exclude or engage?” “What are the impact on the portfolio when you exclude or engage?” We were really trying to find objective material to engage with our clients.”

On the relative effectiveness of engagement and exclusion, Briol said: “If I think about the pension funds that we have, they typically favour engagement over exclusion where they might set a deadline for any transformation to be effective. If this does not happen, the conviction is that naturally those investments would not bear any value residually so they would progressively be exited from the portfolio.”

As a custodian to client assets, there is, of course, only so much that Pictet can do to promote responsible investing. “We have convictions as a bank but we can’t exclude investments from our client portfolios. So it’s more about engaging and providing them with transparency and a different perspective,” Briol said.

Asked if ESG has lost some momentum due to the European energy crisis linked to the Russian invasion of Ukraine, Briol believes these events are testing firms’ commitment.

He said: “I think now opportunism is over. A lot of people were just taking advantage of this easy label but now the industry is becoming more stringent and that is a positive development. That said, I think the acid test is ahead of us.

“For the last 10-15 years, everyone had the tailwind effect and being virtuous was not something that had a price. Now it is changing so it is going to be interesting to see going forward how those convictions stand the test in terms of performance. The jury is still out on that.”

Briol said the regulatory pressure around responsible investing is not going to ease up, however, and that will ultimately be telling: “It is a mixture of bottom-up pressure from clients, raising questions and I think that will accelerate with the new generation so that will only accelerate. And there is top-down pressure from the regulator. Nothing is realistically going to happen unless there is pressure from the regulator and they will continue to apply that.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you