Phelps reflects on 18 months running RJ O’Brien in Europe and Middle East

September 1 marked 18 months since Mark Phelps became head of Europe, Middle East and Africa at RJ O’Brien, the world’s oldest and largest independent futures broker.

In that time, Phelps has helped RJO navigate a period of extreme volatility in many of the firm’s key markets such as commodities, interest rates, equities and foreign exchange while higher interest rates have boosted the bottom line.

He has also worked with the firm’s senior management in Chicago to continue RJO’s growth, both geographically into new markets such as Dubai and by diversifying the products offered by the group, partly into markets beyond listed derivatives.

Reflecting on that time, Phelps said: “As soon as I joined, I knew it was a great decision though I can’t say I was able to enjoy the first few weeks as it coincided with the start of the Ukraine/Russia war. You always want to see some market volatility when you’re in my seat but not like that. It was a bit of a rude awakening for me.”

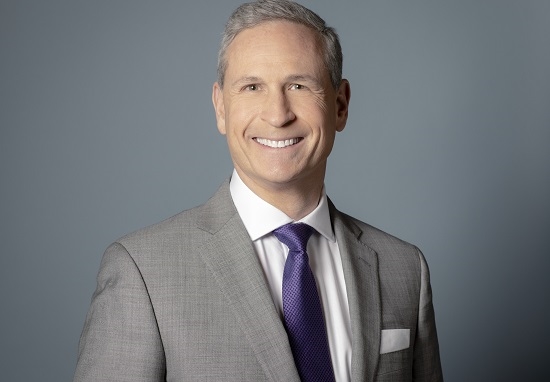

Mark Phelps (left) and Adam Solomons

His first weeks also included the closure of the London Metal Exchange’s nickel market on March 8 which threw up an unprecedented set of challenges for LME member firms such as RJ O’Brien.

When Phelps joined RJO in March 2022, he teamed up in London with Adam Solomons, deputy managing director of RJ O’Brien Limited, who has been with the firm since it acquired Kyte Group in 2015.

Solomons said: “Mark's first six months were seat-of-the-pants because of the Ukraine conflict, but what it showed was that there is robustness in the risk management of RJO globally so whilst these things were going on around us, we were able to manage it. It gave Mark an immediate insight into how the firm works.”

Looking beyond those initial weeks however, Phelps said he is enjoying working on the group’s expansion strategy: “What has really excited me about the last 18 months is the growth that RJO is undertaking geographically and from a product perspective.”

Phelps runs three offices – the regional headquarters in London, the Paris office opened in 2019 and the Dubai hub which began trading in 2018.

He said: “We’re also expanding into other regions; most recently we have set up an office in Singapore and I’m playing a small part in getting that up and running too.”

As well as regional expansion, RJO has in the past years been increasing the universe of instruments covered by its execution and clearing desks.

Phelps said: “We have an established listed derivatives fixed income business here, and over the last 18 months we have started doing US cash treasuries in the region and are getting into the European swaps space in the first half of next year, which will allow us over time to branch out into other currencies, so we’re actively building out our wider fixed income offering.”

Phelps added: “We also have a growing LME desk, having hired a very experienced team a year ago, and this has significantly raised our metals profile and we will continue to expand in that space. On the back of that we have had enquiries from other firms who are keen to access our membership now that we are a better known Category Two member of LME.”

Phelps continued: “We have also invested in a US equities execution team as we continue to widen the asset class offering at RJO. There is a lot going on in London; it’s an exciting time to be at the firm.”

Solomons added: “We are looking to diversify across asset classes to make sure we are not caught out if rates head back towards zero or if commodity hedging requirements reduce. Broadening of our execution offering, alongside the core business of attracting clearing clients, is the most important thing and that is where Dubai comes into play for us.”

RJO acquired in August 2020 Dubai-based inter-dealer broker Lombard Forte Securities.

Futures Commission Merchants (FCMs) like RJ O’Brien benefit from higher interest rates because they can generate better returns in the short-term lending markets so now is a good time to be running an FCM.

Phelps said: “However good you think you are at your job, it’s nice if you’ve got the wind in your sails. I joined RJO at an interesting time for all FCMs with the start of the global rate hiking cycle, and it has been a superb 18 months here from a financial perspective because interest rates have been going up and our segregated funds reached an all-time high watermark during 2023.”

He added: “When you get rising interest rates, you also get volatility, so it’s not just treasury revenue that’s increasing; you get transactional revenue improving significantly too, and this has led to strong revenues for RJO this year.”

And that extra revenue could pave the way for further acquisitions though Phelps said the plan is to focus principally on organic growth.

“RJO will always be interested in looking at attractive opportunities to make acquisitions, and that’s not something that is new since I joined the firm. If we saw an interesting opportunity in the market, we would certainly be keen to have a discussion there.

“That said, our strategy is to do more of the same, so that is find more exchange-traded derivatives clearing clients and more executing brokers in fixed income, energy and LME for example, but we also want to branch out to get more of the new asset classes on board and that is something that I have seen accelerate over the last year.”

The higher revenue from interest rates has made futures broking more lucrative, and, for the first time in decades, there is talk of new entrants. US prime broker Clear Street hired in August the founder and former head of ED&F Man Capital Markets Chris Smith to develop and run a new futures clearing broker, as first reported by FOW.

Phelps said: “We all know that we’ve got a new competitor on its way. RJO’s stance on that is we welcome competition in the market. We’ve been around for 109 years, and in that time we’ve seen FCMs come and go while we are the longest standing independent FCM in the market place and I expect us to grow and thrive irrespective of new entrants.”

He added: “I think it’s a healthy sign for the industry that we are getting new FCMs coming to set-up. I think it’s a good thing.”

Solomons said the barriers to entry and success in the futures clearing business should not be underestimated. “RJO is historically very strong in the US and when it started looking at expanding in London, it took the decision in 2015 to acquire Kyte Group. This immediately allowed RJO to combine its salesforce with a fully functioning FCM and substantially grow the business in the UK and Europe by leveraging off a solid and established infrastructure and client base.”

Solomons added: “In relation to new entrants, it’s very hard to gain traction as a new participant and to attract clients away from their incumbent broker, so whilst we encourage competition, it doesn’t mean it is easy to compete.”

Phelps continued that theme: “We’ve got loyal staff, loyal clients and an amazing reputation and brand. We are not going to be losing too much sleep about new competition in the market; our focus is executing on our own global growth strategy.”

The European managing director added: “I feel like we have assembled some of the best talent in the FCM space at RJO. I inherited some superb staff when I arrived, but we have also managed to bring in some of the most knowledgeable and experienced staff in the industry, for instance by getting Gemma Lloyd and Tracy Hetherington to join RJO over the last 18 months.”

Phelps, who was chief executive of GH Financials before joining RJO, hired in early 2023 Gemma Lloyd as its chief commercial officer from GHF where she was head of business development.

Phelps said: “I came to RJO in large part because of the culture and the people. RJO has an unrivalled reputation for service and prudent risk management but also for the integrity of the staff. I thought before I joined that my personality would fit with these traits.”

Risk management has long been a core function for FCMs but the nature of the risk they face is changing, as demonstrated in January this year when ION Markets, one of the main technology suppliers to FCMs, was the subject of a cyber-attack.

Phelps said: “We were not heavily impacted by the ION event because we do not use ION as our back office provider. But, as a general comment, I don’t think any firm can afford to be too comfortable when it comes to this topic because there is always the potential for other vendors in the space to face a similar problem in the future.”

Phelps added: “From an operational resilience perspective, I won’t be surprised if some new firms come to market with a more cost-effective, less functionally rich version of a back office system that can be the fail-over in case a primary vendor goes down for that exact issue. I think that would be good for the industry. If we can find a more cost-effective way of providing operational resilience, then I think we and every other FCM out there would look at it.”

But, as he marks his first year-and-a-half running RJO EMEA, Phelps’ main focus is the execution of the group’s strategy: diversifying into new geographies and asset classes to complement the group’s long-standing market-leadership in listed derivatives.

Phelps concluded: “We have expanded into UK, European and US equity broking, and we’re still looking to build that part of our business and get into more sovereign and corporate bonds than we’re currently just doing in the Middle East, so the strategy is to continue to grow beyond listed derivatives as well as keep an eye out for interesting acquisition opportunities.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you