Part One: Disruptive pioneer to global powerhouse – 25 years of Eurex

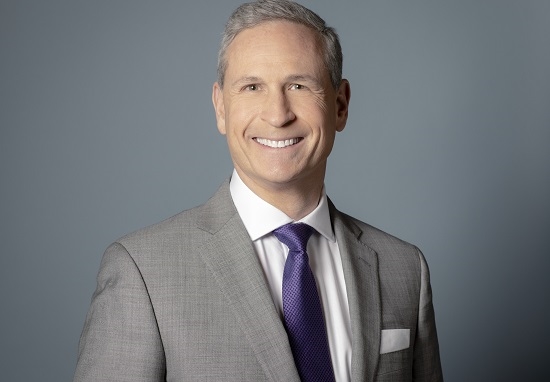

In the first part of three part series, Michael Peters, the chief executive officer of Eurex, and Erik Mueller, the chief executive officer of Eurex Clearing, track the European exchange group’s evolution over 25 years

Eurex is the largest exchange in Europe by some distance and the only European venue to make the top ten of global exchanges by volume of trading.

The exchange has attained that status largely through success in two key product areas – equities and interest rates. The Deutsche Boerse venue has the world’s largest range of MSCI index futures and options products covering every international market or region worth a mention.

The Frankfurt market also has various Euro Stoxx and Stoxx Europe sector indices, including the well-liked Euro Stoxx 50 index, and it is home to the DAX.

On the rates side, Eurex has the Euro-Bobl, which has maturities of seven years or more, the Euro-Bund (five years) and the Euro-Schatz (two year maturity), all of which are heavily-traded and have enjoyed a stellar two years as firms have hedged their German government debt amid inflationary pressure.

In rates, the exchange plans towards the end of this year to relaunch its three month Euribor contract backed by a new incentive scheme that seeks to replicate the success Eurex Clearing has had building swaps clearing volume through its partnership programme.

The Euribor gambit re-ignites Eurex’s decades-long rivalry with ICE Futures Europe (formerly Liffe), the home of Euribor trading.

Eurex’s Euribor play seeks to copy its now-legendary repatriation of the Bund in the late 1990s when Deutsche Boerse managed to take Liffe’s entire Bund book, a success hard-coded into Eurex’s DNA.

Speaking to FOW before Eurex celebrated its 25th anniversary on September 28, the exchange’s chief executive officer Michael Peters said the Eurex’s focus has shifted since 1998 but he fondly remembers the early days.

Peters said: “When you look at the story of Eurex, for me it’s the evolution from a disruptive pioneer to a global powerhouse. What does it mean “disruptive pioneer”? We were and are a market operator that designs, builds, and operates our market infrastructure. That started with our trading infrastructure and continues with clearing and risk management, which is becoming more important.

“We consider ourselves as an organisation that has led the development and set standards with regards to the infrastructure, performance, and throughput figures for trading. But the focus is shifting from trading technology to risk management technology and methodology as capital efficiencies and cross-margining are becoming crucially important.”

Capital savings from portfolio margining of correlated products are one of the key selling points of the Euribor strategy but there are also regulatory tailwinds, as there were in the late 90s when Eurex took the Bund.

Peters said: “If we look back to the start, when DTB and Soffex merged, we were the only two exchanges globally that were fully electronic with an integrated clearing house.”

Eurex was formed in 1998 by the merger of Germany’s Deutsche TerminBoerse (DTB) and Soffex (the Swiss Options and Financial Futures Exchange) which worked together for a decade before coming together to create Eurex.

Peters said: “We were able to offer direct access electronically to anywhere in the world but we also needed the alignment of the regulatory framework. That came in Europe in 1996 with the implementation of the Investment Services Directive and it was at that time that Eurex under Deutsche Boerse decided to open its first foreign office, in Cannon Street.”

Peters and a colleague were the first staff in the London office, located just a stone’s throw from the prodigious Liffe floor, while Heike Eckert, the current Executive Board Member of Deutsche Boerse, set up the group’s first US office, in Chicago.

A key catalyst for Eurex’s success taking the Bund was the introduction in 1996 of the Investment Services Directive which allowed European financial firms to offer their services to clients in other European countries for the first time. “That was a game-changer,” said Peters.

“We received a lot of interest in memberships for Eurex because we could admit members remotely from everywhere in Europe including London which was the most important European financial centre.”

Peters added: “And, in 1998, the entire Bund business shifted to Eurex because of the disruptive element of technology but also remote access, additional efficiency and longer trading hours. Also importantly, we changed the market because the order book became fully transparent which was not the case if you were trading in the pit. With our pioneer spirit, we changed the world of derivatives trading.”

Eurex’s success with the Bund then was due to a combination of factors – regulatory, technological and structural – a formula the exchange plans to emulate with Euribor.

Peters continued: “And that was part of our DNA that continued over time. If you look at the next major event where technology and a big political decision came together was the start of the European Monetary Union.”

The EMU, introduced in stages through the 1990s, paved the way for a European equity market and the European equity derivatives market that Eurex dominates today.

Peters said: “We started in the index derivatives space, like every exchange did, with a local equity index offering but then, in 1999, investors started looking for exposure to Europe and that was the start when we listed the first European indices, with the STOXX family, and we went on to establish STOXX as the global European benchmark.”

And then, in 2008, Lehman Brothers collapsed and the function of exchanges and clearing houses changed forever.

Peters said: “Another key event was the Lehman default and the Pittsburgh G20 meeting of 2009 where the politicians decided the over-the-counter (OTC) market should be made fundamentally safer through a robust risk management methodology and a proper collateralisation methodology with central counterparties and exchanges playing an important role.”

The reforms introduced to shore up the OTC markets, such as the requirement that vanilla products were reported to a regulated entity and cleared through a clearing house, effectively opened this vast market up to exchange groups like Eurex for the first time.

New capital charges on OTC products like dividend and total return swaps paved the way for exchanges like Eurex to offer capital-efficient listed futures, a trend known as futurisation.

Peters said: “A key early initiative was the creation of a regulated and centrally cleared dividend futures and options market which had been the dividend swap market based on individual agreements between two counterparties. Jointly with the market, we standardised dividend swaps into dividend futures and later options, first for indices and later single names.”

“This was a huge success and the banks told us the standardisation provided much more growth opportunity than they had previously seen in the OTC space.”

To be continued on October 2

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you