Charlie Amesbury on Redefining collateral mobility

Redefining collateral mobility

Collateral management should no longer be reviewed only as an operational pain point, but as a strategic differentiator for those that do it well!

This article is part of the 2023 Collateral Guide, which can be accessed here.

Over €24 trillion (£20.6 trillion) of securities were allocated to collateralise securities lending, repo and margin obligations at the end of 2022. Whilst the size of the market is staggering, traditional collateral management methods to manage collateral across a fragmented global custody network can create significant inefficiencies and pain-points for market participants. Clients need to access and allocate collateral between counterparts, from different custody locations, between triparty agents and custodians. The inherent fragmentation of securities settlement system infrastructure and the inefficient collateral management mechanisms linked to it can cost a Tier-1 participant up to €50-100 million per year.

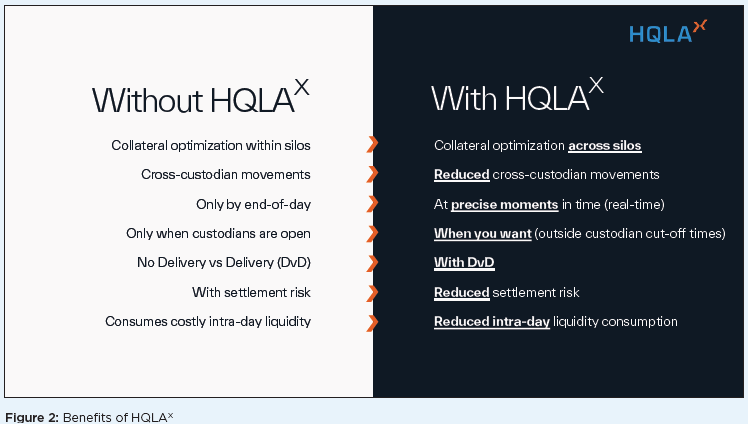

Cross-custody movements of inventory often consume precious intraday liquidity and can create costly intraday credit (RWA) exposures. The inability to move assets in an agile, real-time way often results in sub-optimal allocation of cheapest to deliver assets, which means market participants are leaving money on the table. Furthermore, collateral immobility related to cut-off times leads market participants to carry excess collateral buffers (buffers on top of buffers), which create a significant drag on bottom line profitability. Lastly, cross-custody movements of securities are also subject to costly settlement fails risk.

Turning a problem into an opportunity

Our goal at HQLAx is to eradicate these inefficiencies and significantly reduce our clients’ costs. By dramatically improving collateral mobility, we are enabling our clients to optimise their collateral management, improve liquidity, reduce risk and to have greater certainty and control.

Our platform enables ownership of collateral to be transferred without having to move the underlying collateral from one custodian to another.

Ownership of securities is transferred whilst the securities themselves remain static, in their current custody location. This allows for ownership transfers of securities to happen in real-time and enables our clients to satisfy their collateral obligations with much greater precision.

A trusted third party uses the HQLAx ledger as its golden source of truth for ownership of securities under its custody. A client’s banking operations teams simply instruct the on-ramping of inventory onto the HQLAx ledger. To meet collateral obligations, the ownership of that inventory can be transferred and registered, all within the HQLAx ledger. There is no physical movement of the securities. The HQLAx ledger is updated to effect legal title transfer of securities whilst the underlying securities remain with preferred custodians.

Covering the Market

On the pathway to redefining collateral mobility, HQLAx is expanding its product suite to service the complete range of collateral obligations across securities lending, repo, and margining. As we look back to figure 1, our live products cater for the securities lending market, which makes up 10% or €2.4 trillion of assets held for collateral obligations. As such, we are expanding our product set to cater for as large share of €24 trillion market as possible, and the addition of DvP repo and margin management capabilities are central to that.

We are particularly excited to see the progress of a number of projects that have been going on in the background in the DvP repo space as we work on a scalable ‘plug and play’ orchestration process across multiple solutions. HQLAx does not have cash on ledger, so we have been working to ensure our digitised collateral is compatible to exchange versus both fiat and digital equivalent currencies.

In the digital cash space in particular, we have been working alongside market leading providers in Fnality and Onyx by J.P. Morgan and are targeting the execution of a DvP repo by the end of this year. Not only does this bring a new product segment to market, it has also been an invaluable process to ensure our platform is interoperable with other digital ledgers and solutions providers in order to be able to service the market participants with whomever they choose to partner with.

How it works: DvP Repo

1. The cash provider and cash taker agree the DvP repo in the marketplace layer which communicates the transaction to HQLAx.

2. The cash provider ensures that sufficient cash is positioned on the digital cash ledger and the cash taker positions sufficient eligible collateral on HQLAx to effect the settlement of the trade.

3. When the value time is reached, the DvP repo is settled atomically as a result of the ownership of a Digital Collateral Record (DCR) and the respective digital cash balance being updated across both platforms. The swap is only completed when both ledgers confirm that all criteria have been fulfilled.

4. Ensuring that each ledger’s boundaries are respected, no collateral is represented on the digital cash ledger and no cash is represented on HQLAx.

This product not only allows the ability to trade repo intra-day or term at precise moments in time, it also improves the mobility and liquidity of collateral giving the facility to settle transactions across regions, regardless of market opening hours. This will enhance resilience, reduce risks, and reduce the problem of fragmented liquidity.

Moving onto our margin management tools for both OTC and CCP derivative exposures, we have been working alongside market incumbents to enhance margining options compared to solutions offered today. We can take the operational headache away from allocating ISINs to cover margin calls, allow for automated substitution and pave the way for real-time margining.

How it works: Margin Management

1. The client moves securities to the HQLAx platform where they are linked to a Digital Collateral Record (DCR) at the ISIN level.

2. The ISIN DCR can then be transferred to another participant to fulfill a VM requirement at any time.

3. HQLAx confirms the transfer of ownership instantaneously.

This will make collateral settlement seamless with on-ledger transfer accelerating the collateral mobility between long boxes. It will mitigate the operational backlog that occurs for margin processing for non-cash collateral and therefore reduce risk and regulatory exposure. Simply put, the aim is to make allocating non-cash collateral in the form of DCRs as easy and as fast as allocating cash, thereby increasing utilisation of collateral while decreasing the use of more costly cash.

Through offering DvD, DvP and margin management products, whilst considering the underlying work of connecting with current market infrastructure players and other digital ledgers, HQLAx is creating a fully interoperable platform, the platform to digitise collateral.

Frictionless, precise and real-time transfer of ownership of securities

The benefits of using DLT in the collateral management space are clear. Clients can increase the mobility of assets that have previously been trapped in custody or triparty siloes, are able to mobilise assets that have been hard to fund through traditional settlement chains and benefit from reduced operational processing timeframes.

As clients continue their journey into the DLT world, they need to be able to process transactions between the two ecosystems during the transition period, to integrate both the existing pools of collateral and the assets that are on-ramped to a ledger. Integrating the HQLAx platform with a client’s optimisation engine can help with this and further maximise collateral optimisation across both collateral obligations and all custodians / triparty agents. The Optimisation Engine can view both the on ledger and off ledger collateral along with the obligation and can therefore determine the optimal allocation of those assets.

A great starting point is to analyse your banks existing collateral footprint and annual costs for cross-custody movements of inventory to understand the bottom-line benefits of using solutions such as HQLAx and to move towards a more frictionless, precise, and real-time collateral management.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you