Part One: Sucden Financial chief Bailey discusses the LME after nickel

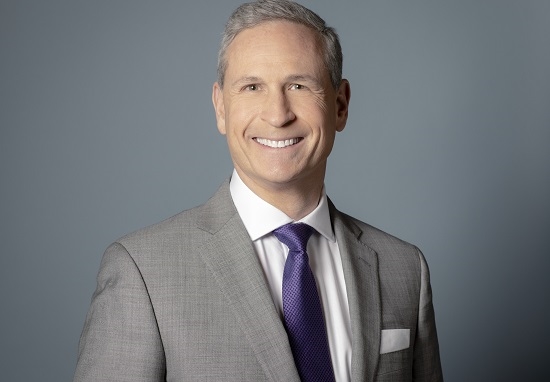

As one of the eight category one members of the London Metal Exchange, Sucden Financial and its chief executive officer Marc Bailey have lived every second of the LME nickel saga.

Speaking to Global Investor on the eve of LME Week which started on October 9, Bailey said his firm has changed its behaviour since the LME was forced to close its nickel market in March 2022.

The Sucden chief executive said: “The issue with volatility is how it effects our liquidity. One of the things we have been a lot more cautious of since last year is making sure that all our accounts are not just sufficiently margined but that they have liquidity to manage any unexpected volatility.

“The other lesson is the initial margin set at the exchange is something that you cannot resolutely depend on, that is, you need to make an independent risk assessment of where you think risk is and, if necessary, you need to have margin levels above that.

“At times we have done that. We have looked at the volatility, felt the margin was too low, so we increased our margins and then two or three weeks later, the exchange increased theirs,” Bailey said.

The Sucden Financial chief said exchanges’ initial margin targets tend to be “quite a long way away from where the limits are”. The target for initial margin at the LME for example is around 8% while the smallest daily limit is 12.5% and some days IM hits 15%, he said.

Ultimately, Bailey believes the regulators that sign off the exchange margin methodologies need to do more.

“That said, we have all learned that in cases of extreme volatility, no margin number is going to protect you. You can’t run a business based on a 300% IM rate which is what the market would have needed to protect us from the nickel spike.”

While the chief exec warns against being wholly reliant on exchange margin calculations, he believes that more could be done to prevent spikes from happening in the first place through counter-cyclical buffers, a key recommendation of the Turner report into the banking crisis of 2008.

“One of the things we see consistently with the exchanges is their methodology incorporates the spike once it has happened as opposed to having sufficient counter-cyclical buffers in the number before.”

Bailey argues these buffers are valuable because the tendency is for margin levels to drop during periods of low volatility which makes the market vulnerable when volatility inevitably returns. “Counter-cyclical buffers are a good idea but, with regard to this latest era of volatility, I feel that is something the regulators should focus on,” he said.

Bailey also believes that circuit-breakers should be more widely adopted in the commodities markets: “So I like the introduction of circuit-breakers or limits because most corporates only have the ability to pay margin on T+1 rather than paying margin on T, so to have an efficient market structure, you have got to allow the corporate treasurers the ability to make payments on T+1 rather than just squeezing them out of positions because they can’t make a payment by a cut-off time.”

The Sucden Financial chief said these limits are also welcome because they prioritise the interests of “genuine business before speculators”.

He also likes the efforts by the LME to improve its oversight of the vast over-the-counter (OTC) market in LME metals which contributed to the nickel price spiking and ultimately led to the market being suspended.

Bailey said: “I think the most important about this looking back was the need to have greater transparency at the exchange level over the entirety of the risk that was in the system. We could look at our book and the exchange could look at all of our books but nobody was looking at all our books plus the OTC so bringing the OTC piece into the exchange’s scope is 100% the right thing to do.”

He added: “So, when you get a situation where positions are big compared to open interest or deliverable supply, the exchange should be able to have a say in that so that post-event reform makes a lot of sense.”

Bailey is less comfortable however with the LME using the volume weighted average price (VWAP) methodology to calculate its closing prices.

“One of the things the exchange has done more recently – which I am less enthusiastic about – is the closing price based on VWAP which makes it more difficult for trade hedgers to get the effective closing price and easier for algorithms to hunt trade flow.

“The conclusion I have come to, and I have shared this with the exchange, is the most likely outcome is an increased hedging cost to trade clients, which changes the ability of one group over another to get closer to the closing price.”

LME nickel trading volumes predictably collapsed after the March 2022 closure but they have picked up slightly this year as the memory fades and the LME’s has rolled out its reforms.

Bailey said: “Nickel volumes have started to come back and there have been third Wednesdays when the volume has been about 12,000 contracts. The exchange publishes a concentration risk score and the concentration risk for nickel has gone from 800 to 1,800 over the last year and this is linked to the average daily volume. That’s quite a good health indicator.”

He continued: “The most important thing is that people see the business returning to a price that is relevant. So now we have a price where the trade recognise that price and buyers and sellers are happy to exchange at that price. That has given confidence to people to use the contracts again.”

Asked why a rival exchange such as CME has not sought to capitalise on the LME’s nickel problems by launching a rival product, Bailey said there have been moves to a cash-settled contract but the LME’s physical delivery network is almost impossible to replicate.

He said: “Because of what happened, firms started thinking of joining an alternative benchmark so I do still think there are some challenger benchmark opportunities that still may have some legitimate purpose in the industry.

“For a nickel contract to be successful you need the trade corporate clients and the ability to deliver and the exchange has a network, which, not withstanding its own problems, is still respected.”

Bailey added: “If you don’t have that and you want to go the non-deliverable route, you need an independent valuation from a cash source to benchmark your future settlement against, like with coal. There are one or two organisations seeking to achieve some sort of cash benchmark. If they were able to do that, you could see a financially settled instrument being launched.”

Looking ahead, Bailey said Sucden Financial is seeing increased demand from clients to trade bilaterally and this is something the firm is looking to embed in its technology stack.

“Within the LME space, we are seeing more member-to-member bilateral trading, so people are coming to us trying to get access to our pricing so we will be working with a community that we have previously been unable to touch but now, using technology, we think we will be able to bilaterally price them and trade against them on a bilateral basis.

Bailey concluded: “What we are talking about is a slight fragmentation of the exchange surface so, like on the London Stock Exchange, there is the exchange hub but there is trading that goes on around the hub also.

“Obviously, the LME is not dematerialised so the difference will be that the bilateral trading will be more with financial institutions and the corporate hedgers will still need to use the delivery mechanism. I think over time we could see some fragmentation of pricing.”

Sucden Financial is celebrating this year its fiftieth anniversary with various activities aiming to raise £50,000 for an East London community charity.

To find out more about the Sucden Financial Community Fund, please click here, and to make a donation, please visit Sucden Financial’s JustGiving page.

To be concluded on October 10

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you