ANALYSIS: Indian equity index options go from strength to strength

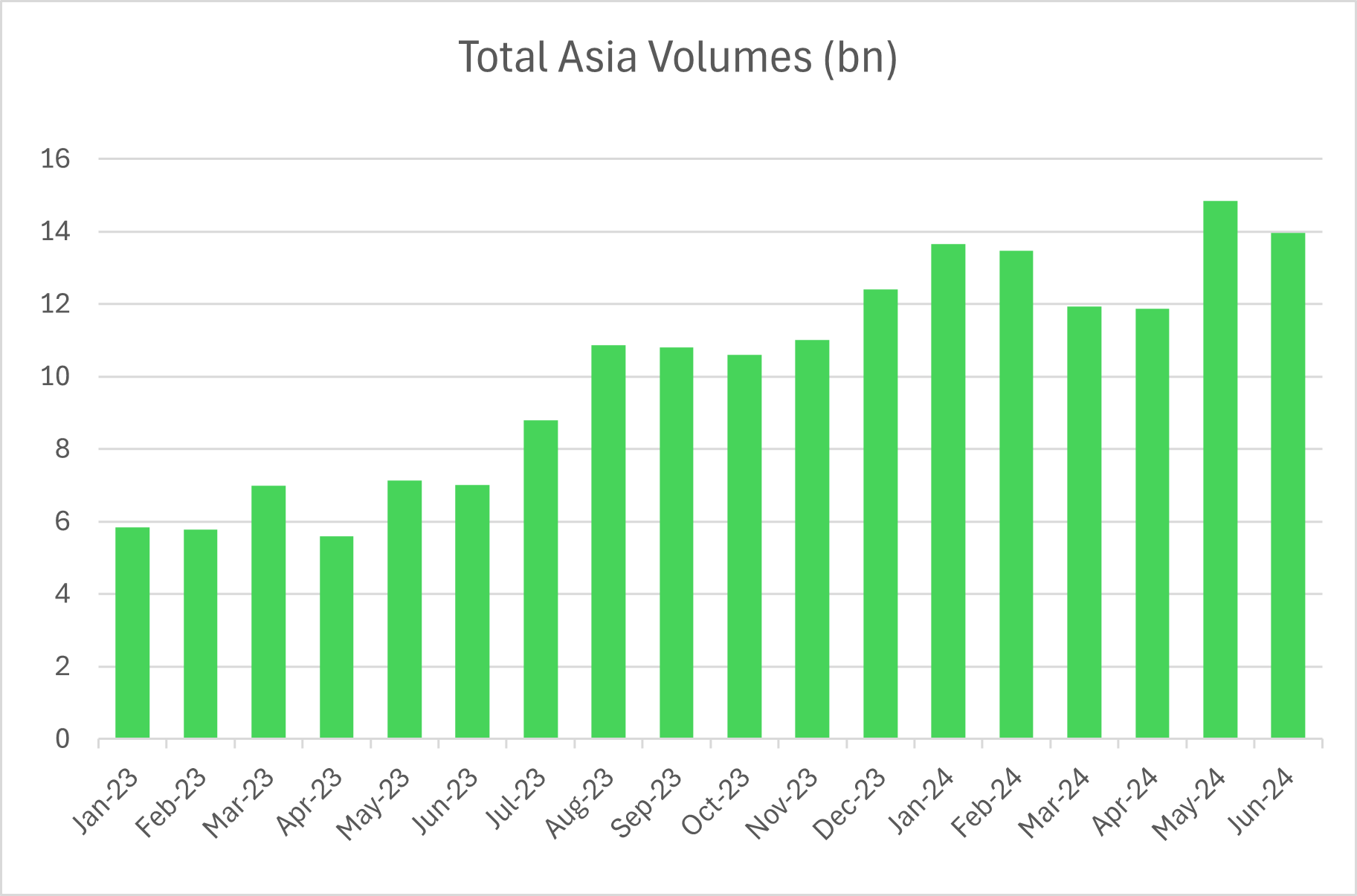

Asia continues to drive growth in the global futures and options industry, with Asian trading volumes breaking 40 billion lots in a single quarter for the first time.

FOW Data shows Asian exchanges traded 40.7 billion contracts in the three months to the end of June, which was up 106% from the second quarter of last year and 4% higher than the first three months of 2024.

June was the second busiest month on record for Asian futures and options exchanges, reporting 13.96 billion lots, which was up 99% on June 2023 and down 6% on May’s record of 14.857 billion contracts traded, FOW Data shows.

Chart One: ASIAN FUTURES AND OPTIONS TRADING VOLUME

Source: FOW Data

The main drivers of growth in Asia are a handful of Indian equity index options contracts, listed on Mumbai’s National Stock Exchange of India and Bombay Stock Exchange, which currently host the six most-traded listed derivatives globally.

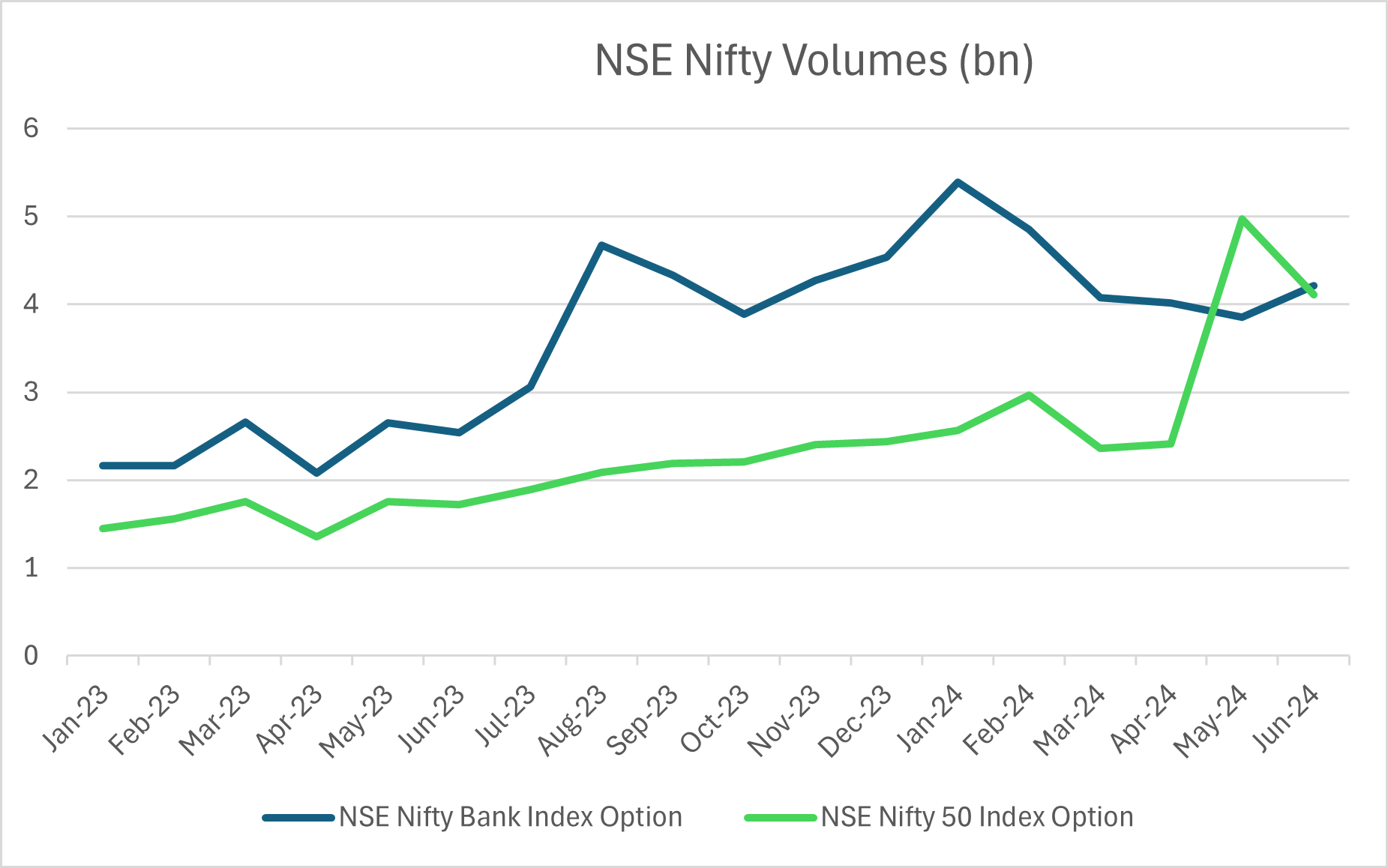

The top contract in Asia and globally last month was the National Stock Exchange of India’s Nifty Bank index option which traded in June 4.208 billion contracts, which was up 65.6% on the same month in 2023, according to FOW Data.

The NSE bank index option traded 12.071 billion lots in the second quarter, which represented an increase of two-thirds on the same quarter last year and a decline of 15.6% on the previous quarter, an all-time record for the Indian contract. The contract had open interest of 6.56 million lots at the end of June.

The NSE Nifty Bank index option took in June top spot from NSE’s other main index option contract, the Nifty 50 index option.

The Nifty 50 index option on the Indian blue-chip standard traded 4.112 billion lots last month, according to FOW Data, which was up 138.7% on June 2023, albeit down slightly from the trading record for the product in May.

In the second quarter, the options contract was up 45.5% on the previous three months. This rapid increase was the main driver for the increase in overall Asia volumes in Q2. The open interest on the NSE Nifty 50 option was 10.35 million lots at the end of last month, according to FOW Data.

Chart Two: NATIONAL STOCK EXCHANGE OF INDIA’S NIFTY BANK AND NIFTY 50 OPTIONS

Source: FOW Data

The two largest Indian index options contracts jointly contributed an extra 4 billion lots to the Asia June volumes compared to June 2023 and an additional 11.5 billion lots to the second quarter totals versus the same period last year.

Another key factor in the Asian quarterly volume record has been the success of Bombay Stock Exchange’s S&P BSE Sensex equity index option, which references the oldest Indian index, made up of 30 of the largest and most liquid Indian blue-chips listed on the BSE.

The S&P BSE Sensex equity option, which has emerged as the world’s third most popular listed derivative just over a year after launching in May 2023, reported 1.971 billion lots traded last month, which was more than 58 times the total in June last year but 14.2% below the previous month’s record of 2.297 billion lots.

The BSE equity index option traded 5.853 billion lots last quarter, according to FOW Data, which was more than 175 times the volume in the second quarter of last year. Compared to the two larger NSE equity options contract, the BSE S&P Sensex equity options’ relatively low open interest of 42,650 lots suggests retail traders make up the vast majority of the activity in this market

The fourth most-traded contact in Asia (and the world) is the National Stock Exchange of India’s Nifty Financial Services equity index option, which traded 1.264 billion lots in June, up 8.5% on the same month last year and 0.8% on the preceding month.

The fifth most popular listed derivative is the S&P Bankex equity option on the BSE, which traded 617.4 million lots last month after launching in May last year, and sixth on the list is the NSE Nifty Midcap Select equity index option. The remainder of the global top ten list comprises three Brazilian futures traded on B3 and CME’s three month SOFR futures contract.

Rutesh Durve, director of Business Development and Relationship Management at Nuvama Asset Services, told a FOW conference in April that, while India is perceived as complicated and difficult to access, there are different routes to market such as trading through an onshore broker or an international firm that has a presence in India. Durve said: “At some point, India becomes large enough that you need someone onshore.”

FOW will host on September 19 2024 the fourth edition of its flagship Indian conference in Mumbai. To find out more about the event, please click here.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you